Ericsson (ERIC) Misses on Q3 Earnings, Ups 2020 Sales View

Ericsson ERIC reported mixed third-quarter 2019 financial results, wherein the top line beat the Zacks Consensus Estimate but the bottom line missed the same.

It should be noted that the Swedish telecom equipment maker’s operating income was impacted by a provision of SEK 11.5 billion related to a resolution of the investigations by SEC and DOJ in the United States.

Net Loss

On GAAP basis, net loss for the September quarter was SEK 6,229 million ($649.4 million) or loss of SEK 1.89 (20 cents) per share against net income of SEK 2,745 million or SEK 0.83 per share in the prior-year quarter. The year-over-year decline was primarily due to the above-mentioned cost provision.

Non-IFRS loss came in at SEK 1.80 (19 cents) per share against earnings of SEK 1.03 per share in the year-ago quarter. The bottom line compared unfavorably with the Zacks Consensus Estimate for earnings of 8 cents.

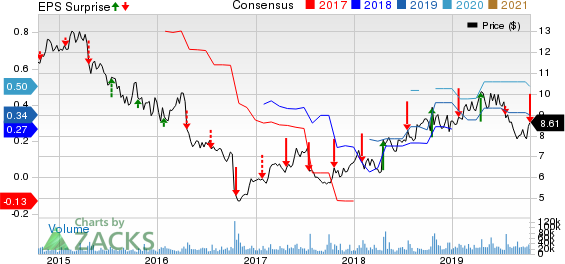

Ericsson Price, Consensus and EPS Surprise

Ericsson price-consensus-eps-surprise-chart | Ericsson Quote

Sales

Quarterly net sales increased 6.2% year over year to SEK 57,127 million ($5,956.1 million), primarily driven by strong growth in North America and North East Asia. The top line surpassed the consensus estimate of $5,903 million.

Segment Results

Net sales at Networks increased 9.5% year over year to SEK 39.3 billion ($4.1 billion). The rise was mainly driven by good traction for the Ericsson Radio System. Notably, sales growth in North America was strong, backed by 4G and 5G investments. The segment’s gross margin grew to 41.6% year over year from 41.3% led by higher IPR licensing revenues and a favorable business mix. Operating margin improved to 18.4% from 15.7% on the back of higher sales and gross margin. The company’s target for Networks is to generate an operating margin of 15-17% (excluding restructuring charges) by 2020.

Digital Services’ net sales increased 10% year over year to SEK 9.9 billion ($1 billion), driven by Cloud Core and Cloud Communication sales in North America and North East Asia. The segment’s gross margin increased to 37.9% from 35.7% supported by cost reductions and improved business mix, partly through a higher share of software sales. Ericsson’s top priority is to continue to grow the new portfolio while turning Digital Services into a profitable business, targeting low single-digit operating margin by 2020 (excluding restructuring charges).

Net sales at Managed Services fell 1.5% year over year to SEK 6.4 billion ($0.7 billion) due to customer contract exits. Gross margin grew to 17.9% year over year from 12.5% mainly as a result of efficiency gains and increased add-on sales. Operating margin improved to 8.8% from 6.3%, driven by higher gross margin. The company’s target for Managed Services is 5-8% operating margin (excluding restructuring charges) in 2020.

Net sales at Other (including Emerging Business, iconectiv, Red Bee Media and Media Solutions) declined 33.3% year over year to SEK 1.6 billion ($0.2 billion), mainly due to the 51% divestment of MediaKind. The segment’s gross margin decreased to 20.2% from 32.3%.

Other Details

Overall gross margin improved to 37.7% year over year from 36.5% driven by improvements in Managed Services and Digital Services. Total operating expenses were SEK 14.2 billion compared with SEK 16.4 billion in the prior-year quarter, primarily due to lower selling and administrative expenses. Operating loss for the third quarter was SEK 4.2 billion against operating income of SEK 3.2 billion in the year-ago quarter. This was due to a provision of SEK 11.5 billion related to the investigation by the SEC and the DOJ.

At September-end, Ericsson had announced commercial 5G deals with 27 named operators. Across radio and core, it supplied equipment to 19 live 5G networks. On Oct 2, 2019, the company completed the acquisition of Kathrein’s antenna and filter business in order to expand its Radio System portfolio with new products and capabilities.

Cash Flow & Liquidity

During the first nine months of 2019, Ericsson generated SEK 16,377 million of cash from operations compared with SEK 5,055 million in the year-ago period. For the first three quarters of the year, the company’s free cash flow (excluding M&A) was SEK 11.8 billion compared with SEK 1.3 billion in the prior-year period.

As of Sep 30, 2019, Ericsson had SEK 51,183 million ($5,211.8 million) in cash and cash equivalents with SEK 37,153 million ($3,783.2 million) of non-current borrowings. Its net cash as of the same date was SEK 37.4 billion ($3.8 billion) compared with SEK 32 billion a year ago.

Going Forward

Ericsson continues to witness strong momentum in its business, based on the strategy to increase its investments for technology leadership, including 5G. In Networks business (which accounts for the lion’s share of total sales), the company’s ongoing activities are to invest in R&D to safeguard a leading product portfolio and cost leadership; increase investments in automation and serviceability driving down costs; and selectively gain market shares based on technology and cost competitiveness.

Further, the company communicated that it is on track to achieve its new financial targets. Sales for 2020 are currently expected between SEK 230 billion and 240 billion (previously SEK 210-220 billion), based on a SEK/$ rate of 9.50. The increase is driven by Networks, partly supported by currency effects.

Operating margin target for 2020 (excluding restructuring charges) remains unchanged at more than 10% of sales. Operating margin target of 12-14% for 2022 (previously more than 12%), excluding restructuring charges, based on anticipation to grow faster than the market.

Zacks Rank & Stocks to Consider

Currently, Ericsson has a Zacks Rank #4 (Sell). A few better-ranked stocks in the broader industry are Nokia Corporation NOK, PCTEL, Inc. PCTI and T-Mobile US, Inc. TMUS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nokia surpassed earnings estimates thrice in the trailing four quarters, the average positive surprise being 89.3%.

PCTEL surpassed earnings estimates thrice in the trailing four quarters, the average positive surprise being 146.4%.

T-Mobile surpassed earnings estimates in each of the trailing four quarters, the average surprise being 17.9%.

Conversion rate used:

SEK 1 = $0.104260 (period average from Jul 1, 2019 to Sep 30, 2019)

SEK 1 = $0.101827 (as of Sep 30, 2019)

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ericsson (ERIC) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

PC-Tel, Inc. (PCTI) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance