Equinor (EQNR) to Acquire U.K. North Sea Assets From Suncor

Equinor ASA EQNR is in the process of reaching an agreement to acquire Suncor Energy’s SU oil and gas assets in the U.K. North Sea for $1 billion, per a Reuters report.

Located about 130 kilometers northwest of Shetland Islands, Rosebank is one of the largest developments in the U.K. North Sea. Equinor operates the Rosebank field with a 40% interest.

The to-be-acquired assets involve Suncor’s 40% stake in the offshore Rosebank oil and gas project. Equinor and partners are expected to make a final investment decision on Rosebank’s development in 2023.

The agreement also includes a 29.9% stake in the Buzzard oilfield, the largest contributor to the Forties crude stream. Forties is one of the North Sea crude oil grades supporting the Brent crude benchmark, delivering more than 20,000 barrels of oil equivalent net to Suncor.

In 2022, Suncor signaled plans to divest its upstream assets in the U.K. as it seeks to focus on its core oil-sand operations in northeast Alberta. Last August, Suncor divested its upstream assets in Norway for more than $400 million to private equity-backed Norwegian oil and gas firm Sval Energy.

The agreement came after the U.K. government’s decision last year to raise a windfall tax on North Sea producers to 35% from 25%, bringing the total tax rate to 75%. This is one of the highest tax rates in the world.

The windfall tax has driven many companies, including Equinor, to inform that they could reduce future investments in the U.K. North Sea. The possible acquisition could give Equinor a significant proportion of tax losses, which it could use to offset further investments in the U.K. North Sea.

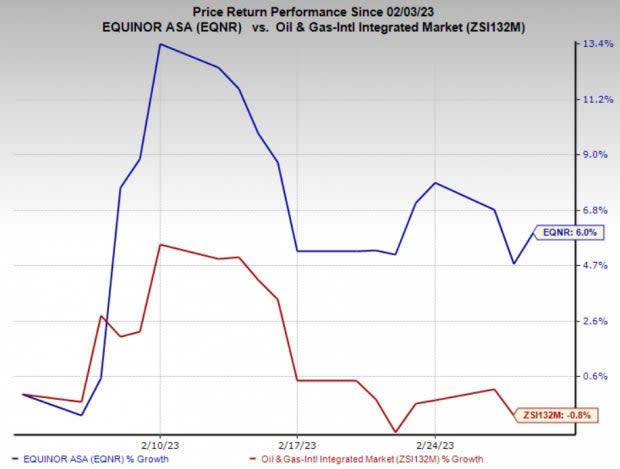

Price Performance

Shares of Equinor have outperformed the industry in the past month. The stock has gained 6% against the industry’s 0.8% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Antero Midstream Corporation AM reported fourth-quarter 2022 adjusted earnings per share of 20 cents, beating the Zacks Consensus Estimate of 17 cents. The strong quarterly results were primarily driven by higher freshwater delivery volumes and increased average freshwater distribution fees.

For 2023, Antero Midstream expects a net income of $340-$380 million, indicating an increase from the $326.2 million reported in 2022.

Nabors Industries Ltd. NBR reported a fourth-quarter 2022 loss of $3.89 per share, wider than the Zacks Consensus Estimate of a loss of $1.06. The underperformance was primarily due to much higher year-over-year total costs and expenses.

Nabors anticipates free cash flow for fiscal 2023 at $400 million. Nabors expects Drilling Solutions’ first-quarter EBITDA to increase 6% over the fourth-quarter reported level. Finally, the adjusted EBITDA for NBR’s Rig Technologies segment is estimated to be in line with the fourth-quarter reported level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nabors Industries Ltd. (NBR) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance