If You Like EPS Growth Then Check Out BHP Group (ASX:BHP) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in BHP Group (ASX:BHP). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for BHP Group

How Fast Is BHP Group Growing Its Earnings Per Share?

In the last three years BHP Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, BHP Group's EPS shot from US$0.94 to US$1.66, over the last year. Year on year growth of 77% is certainly a sight to behold.

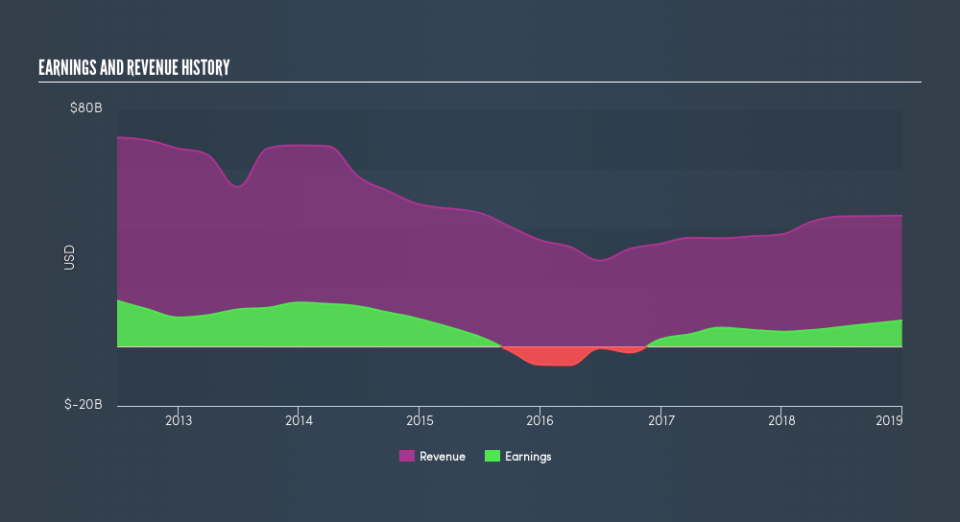

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. BHP Group maintained stable EBIT margins over the last year, all while growing revenue 17% to US$44b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of BHP Group's forecast profits?

Are BHP Group Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$194b company like BHP Group. But we do take comfort from the fact that they are investors in the company. Indeed, they hold US$69m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.04% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add BHP Group To Your Watchlist?

BHP Group's earnings per share growth has been so hot recently that thinking about it is making me blush. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering BHP Group for a spot on your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of BHP Group.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance