With EPS Growth And More, WT Financial Group (ASX:WTL) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in WT Financial Group (ASX:WTL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for WT Financial Group

WT Financial Group's Improving Profits

Over the last three years, WT Financial Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that WT Financial Group's EPS has grown from AU$0.0097 to AU$0.012 over twelve months. That's a 23% gain; respectable growth in the broader scheme of things.

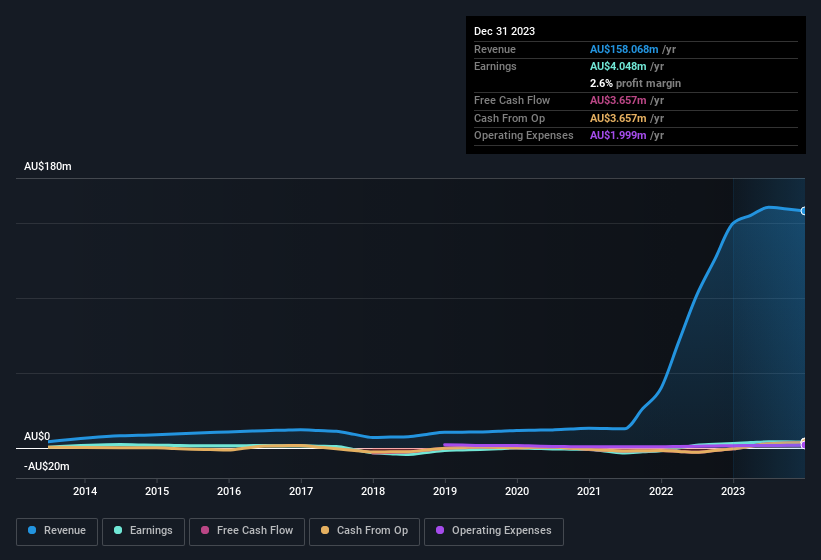

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for WT Financial Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 5.6% to AU$158m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since WT Financial Group is no giant, with a market capitalisation of AU$22m, you should definitely check its cash and debt before getting too excited about its prospects.

Are WT Financial Group Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that WT Financial Group insiders own a significant number of shares certainly is appealing. In fact, they own 44% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only AU$22m WT Financial Group is really small for a listed company. So this large proportion of shares owned by insiders only amounts to AU$9.6m. That might not be a huge sum but it should be enough to keep insiders motivated!

Is WT Financial Group Worth Keeping An Eye On?

One positive for WT Financial Group is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. You still need to take note of risks, for example - WT Financial Group has 2 warning signs we think you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in AU with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance