With EPS Growth And More, NamSys (CVE:CTZ) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like NamSys (CVE:CTZ). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for NamSys

How Fast Is NamSys Growing Its Earnings Per Share?

In the last three years NamSys' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that NamSys' EPS has grown from CA$0.054 to CA$0.062 over twelve months. That's a 13% gain; respectable growth in the broader scheme of things.

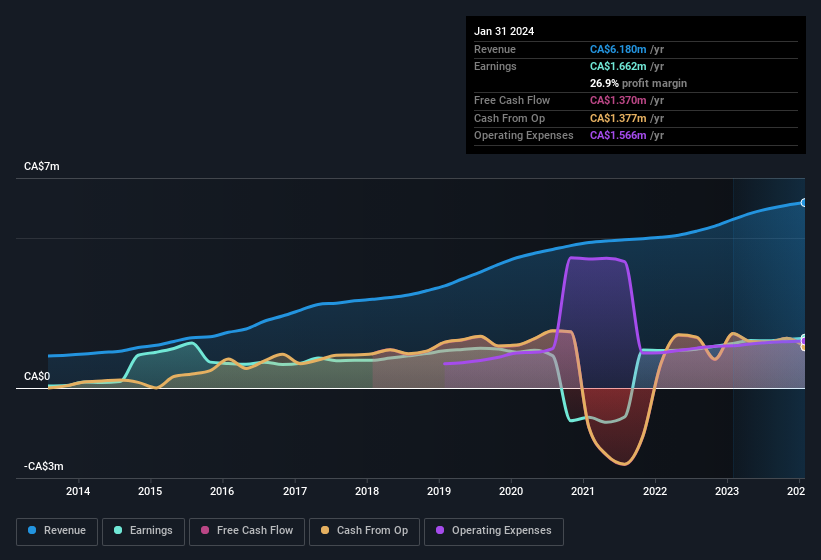

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for NamSys remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 10.0% to CA$6.2m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

NamSys isn't a huge company, given its market capitalisation of CA$23m. That makes it extra important to check on its balance sheet strength.

Are NamSys Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in NamSys will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Valued at only CA$23m NamSys is really small for a listed company. So despite a large proportional holding, insiders only have CA$10.0m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does NamSys Deserve A Spot On Your Watchlist?

As previously touched on, NamSys is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Still, you should learn about the 3 warning signs we've spotted with NamSys (including 1 which doesn't sit too well with us).

Although NamSys certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Canadian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance