With EPS Growth And More, Australian Vintage (ASX:AVG) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Australian Vintage (ASX:AVG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Australian Vintage

How Fast Is Australian Vintage Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Impressively, Australian Vintage has grown EPS by 30% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

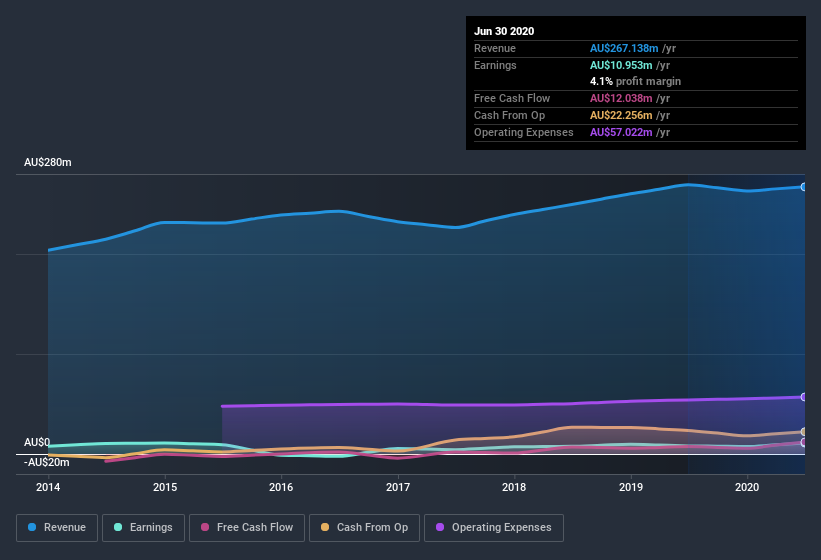

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It seems Australian Vintage is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Australian Vintage EPS 100% free.

Are Australian Vintage Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months Australian Vintage insiders spent AU$216k more buying shares than they received from selling them. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. We also note that it was the Non-Independent Non-Executive Director, Jiang Yuan, who made the biggest single acquisition, paying AU$307k for shares at about AU$0.61 each.

On top of the insider buying, it's good to see that Australian Vintage insiders have a valuable investment in the business. Indeed, they hold AU$30m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 17% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Australian Vintage Worth Keeping An Eye On?

For growth investors like me, Australian Vintage's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. You still need to take note of risks, for example - Australian Vintage has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Australian Vintage, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance