EOG Resources (EOG) Q3 Earnings & Revenues Miss Estimates

EOG Resources Inc EOG delivered third-quarter 2019 adjusted earnings per share of $1.13, which missed the Zacks Consensus Estimate by 0.9%. The bottom line also declined from the year-ago comparable quarter’s $1.75 per share.

Total revenues in the reported quarter declined 10% year over year to $4,303 million. Moreover, the top line lagged the Zacks Consensus Estimate of $4,397 million.

The upstream energy player posted weak quarterly results, owing to lower average price realization for crude oil and natural gas. This was partially offset by higher production volumes of the commodities.

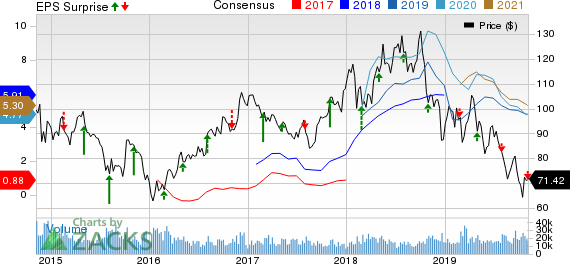

EOG Resources, Inc. Price, Consensus and EPS Surprise

EOG Resources, Inc. price-consensus-eps-surprise-chart | EOG Resources, Inc. Quote

Operational Performance

In the quarter under review, EOG Resources’ total volume rose 11% year over year to 76.7 million barrels of oil equivalent (MMBoe).

Crude oil and condensate production in the quarter totaled 464.1 thousand barrels per day (MBbl/d), up 12% from the year-ago quarter level. Natural gas liquids (NGL) volume increased 11% year over year to 141.3 MBbl/d. Natural gas volume rose to 1,373 million cubic feet per day (MMcf/d) from the year-earlier quarter’s 1,236 MMcf/d.

Average price realization for crude oil and condensates fell 19% year over year to $56.66 per barrel. Quarterly NGL prices declined 58% to $12.67 per barrel from $30.09 in the year-ago quarter. Moreover, natural gas was sold at $2.13 per thousand cubic feet (Mcf), representing a year-over-year decline of 22%.

Operating Costs

Total operating costs increased to $3,475.5 million from $3,274.9 million a year ago. Lease and Well expenses increased nearly 9%, while exploration costs rose 5.2%.

Liquidity Position

At the end of the third quarter, the company had cash and cash equivalents of $1,583.1 million and long-term debt of $4,163.1 million. This represents a net debt-to-capitalization ratio of 19.7%.

In the quarter, the company generated $2 billion in discretionary cash flow, declining 11% year over year.

Drilling Locations

In the September-end quarter, it added 1,700 net premium drilling locations, thereby making its total count of net undrilled premium locations to 10,500. This represents the resource potential of 10.2 billion barrels of oil equivalent.

Guidance

For 2019, the company expects crude oil equivalent volume of 810.1-819.2 thousand barrels of oil equivalent per day (MBoE/D).

For the fourth quarter of 2019, it anticipates crude oil equivalent volume of 818.9-854.9 MBoE/D. Notably, the company tightened its projection for the 2019 capital budget to $6.2-$6.4 billion from $6.1-$6.5 billion mentioned earlier.

Zacks Rank & Stocks to Consider

EOG Resources currently carries a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are CNX Resources Corporation CNX, Contango Oil & Gas Company MCF and Noble Midstream Partners LP NBLX. All the stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CNX Resources beat the Zacks Consensus Estimate in two of the prior four quarters, the average positive earnings surprise being 34.8%.

Contango Oil & Gas is likely to witness bottom-line growth of 87% in 2019.

Noble Midstream’s 2019 earnings projection has been raised over the past 30 days.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Noble Midstream Partners LP (NBLX) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance