EnPro's (NPO) LeanTeq Buyout to Boost Technetics Business

EnPro Industries, Inc. NPO announced yesterday that it has completed the acquisition of LeanTeq Co., Ltd. The buyout agreement was signed between the two parties on Jul 22, 2019.

EnPro’s share price has increased roughly 1.71% on Sep 25, closing the trading session at $68.95.

LeanTeq is engaged in providing services including verification, cleaning and testing to critical components as well as assemblies in semiconductor equipment. This Taoyuan City, Taiwan-based company’s majority of customers comprise foundries, device manufacturers and suppliers of OEM equipment. Founded in 2011, LeanTeq employs roughly 260 people.

Details of the Buyout

Notably, EnPro will integrate the acquired assets with the Technetics division (the manufacturer of engineered components for use in nuclear, semiconductor and aerospace markets) of its Sealing Products segment.

EnPro anticipates that the LeanTeq buyout will add vigor to Technetics’ operations by bolstering its product offerings, manufacturing capabilities, technological knowhow and strengthening its aftermarket business. LeanTeq’s strong management team is an added advantage. The LeanTeq buyout is also expected to boost EnPro’s earnings in the first year of completion.

According to EnPro, it financed the LeanTeq buyout through term loan facility, revolving credit facility and other means. Currently, its new amended credit facility of $550 million comprises $400 million of revolving credit facility and $150 million of term loan.

EnPro to Strenghten Portfolio Via Aquisitions

We believe that the latest buyout is in line with EnPro’s policy of acquiring businesses in an attempt to gain access to new customers, regions and product lines.

In July 2019, EnPro acquired a privately held company — The Aseptic Group. The acquired assets were integrated with the Garlock division of EnPro’s Sealing Products segment. Garlock is mainly engaged in supplying fluid handling and sealing products to customers in the process industries.

The Aseptic buyout is anticipated to add vigor to Garlock’s operations by strengthening its product offerings and manufacturing capabilities, and expanding in biopharmaceutical and pharmaceutical industries.

Zacks Rank, Earnings Estimate and Price Trend

With a market capitalization of $1.41 billion, EnPro currently carries a Zacks Rank #3 (Hold).

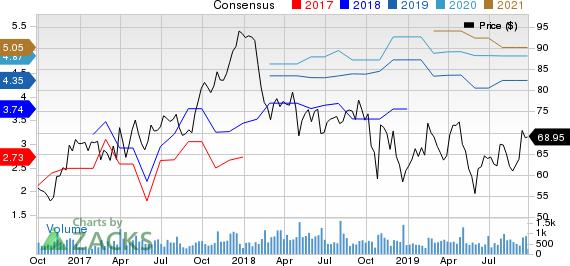

The Zacks Consensus Estimate for EnPro’s earnings per share is pegged at $4.35 for 2019 and $4.87 for 2020, suggesting growth of 5.1% and decline of 0.4% from the respective 60-day-ago figures.

EnPro Industries Price and Consensus

EnPro Industries price-consensus-chart | EnPro Industries Quote

In the past three months, EnPro’s shares have increased 7.9% against the industry’s 0.5% decline.

Stocks to Consider

Some better-ranked stocks in the same industry are Crawford United Corporation CRAWA, Graham Corporation GHM and Chart Industries, Inc. GTLS. While Crawford United sports a Zacks Rank #1 (Strong Buy), Graham and Chart Industries carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for Graham and Crawford United improved for the current year while remained stable for Chart Industries. Further, earnings surprise for the last reported quarter was 11.76% for Crawford United, 100% for Graham and 11.48% for Chart Industries.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

EnPro Industries (NPO) : Free Stock Analysis Report

Hickok Inc. (CRAWA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance