Eni's (E) Versalis & Saipem to Produce Advanced Biofuel

Eni SPA’s E chemical company Versalis recently made a deal with Saipem SpA SAPMF to promote PROESA® technology, which is used for producing sustainable bioethanol and chemicals. In 2015, Eni reduced its stake in Saipem, an oil and gas engineering and equipment provider.

The PROESA®technology of Versalis uses hydrolysis and fermentation process of agricultural waste, energy crops as well as other agricultural biomasses for sustainable bioethanol production. It produces advanced biofuel or second-generation bioethanol without using crops intended for human usage. Per the deal, the commercial features of the proprietary technology’s licensing rights will be managed by Versalis, which will additionally provide training services and assistance. Saipem will likely be in charge of development of the production facilities.

The technology was developed in the Crescentino facility of Versalis and can play a huge role in Eni’s overall decarbonization program. With global bioethanol demand expected to rise in the coming days, as the drive for lower emissions and greener fuels strengthen, the latest deal is likely to be extremely profitable.

The move is expected to boost sustainability of Eni’s chemicals business. Earlier, the integrated energy major made a series of deals with companies like Equinor ASA EQNR, Falck Renewables and others to boost exposure in wind and solar energy production.

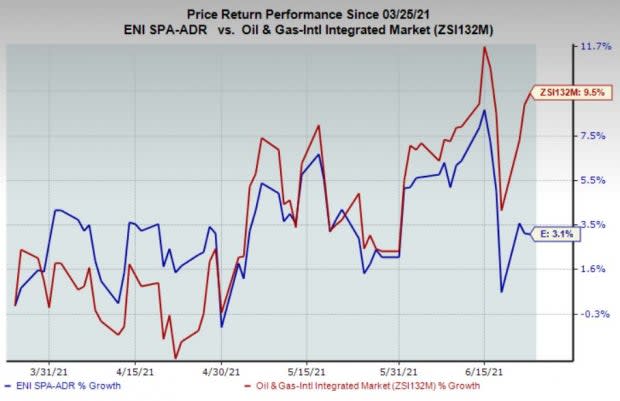

Price Performance

Eni’s shares have increased 3.1% in the past three months compared with 9.5% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Pick

The company currently has a Zacks Rank #3 (Hold). A better-ranked player in the energy space is PHX Minerals Inc. PHX, having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PHX Minerals’ bottom line for 2021 is expected to surge 180% year over year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

PHX Minerals Inc. (PHX) : Free Stock Analysis Report

SAIPEM SPA SAN (SAPMF) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance