Eni's (E) Plenitude Signs Deal to Acquire Italy-Based PLT

Eni SpA’s E renewable energy unit, Plenitude, entered an agreement to fully acquire Italy-based wind and solar developer PLT for an undisclosed amount.

PLT has a 1.6-gigawatts (GW) renewable capacity portfolio in Italy and Spain. The transaction will enhance Eni’s onshore wind capacity in Italy and strengthen its presence in Spain.

Located in Lombardy, Plenitude currently delivers electricity to about 10 million customers in the Europe retail market. It intends to serve more than 11 million customers by 2025 and install more than 30,000 electric vehicle charging points.

Per the deal, Plenitude will acquire PLT Energia and SEF and their respective subsidiaries and affiliates. The acquisition will add more than 400 megawatts of renewable energy assets to Plenitude’s portfolio, most of which are wind farms. Of the renewable energy assets, 80% are in operation. The rest are currently under development and are expected to be up and running in 2024.

Beside this, PLT has a 1.2-GW capacity in development in Italy and Spain, with 60% of the assets remaining in advanced maturity stages. The acquisition will boost Plenitude’s renewable project pipeline to 13 GW. It will also add 900,000 retail customers in its home country.

The acquisition upholds Plenitude’s business model and will enable it to encourage growth in Italy and abroad. The acquisition will enable Plenitude to exceed 2 GW of net installed capacity, in line with the company’s targets. It expects to reach more than 6 GW in 2025.

The agreement is expected to support Plenitude’s growth, and enhance its position in Italy and Spain. The transaction is subject to customary approvals.

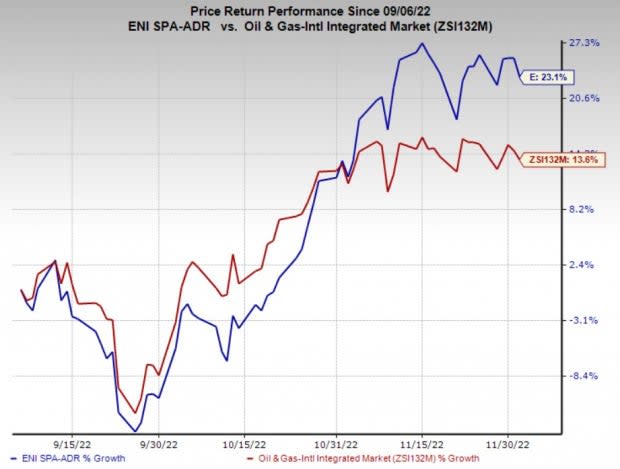

Price Performance

Shares of Eni have outperformed the industry in the past three months. The stock has gained 23.1% compared with the industry’s 13.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Oceaneering International, Inc. OII is one of the leading suppliers of offshore equipment and technology solutions to the energy industry. OII’s third-quarter 2022 adjusted profit of 23 cents per share beat the Zacks Consensus Estimate of 13 cents.

OII is expected to see an earnings rise of 29.4% in 2022. For 2022, Oceaneering projects its consolidated EBITDA to be $215-$240 million and continued significant free cash flow generation to be $25-$75 million.

Helmerich & Payne Inc. HP is a major land and offshore drilling contractor in the western hemisphere, having the youngest and most efficient drilling fleet. HP’s fiscal third-quarter 2022 adjusted profit of 27 cents per share beat the Zacks Consensus Estimate of 5 cents.

Helmerich & Payne is expected to see an earnings surge of 275.6% in 2022. HP boasts a strong balance sheet, carrying $542.3 million in long-term debt. The company’s debt-to-capitalization stands at just 16.6% compared with many of its peers that are hugely burdened with debts.

DCP Midstream, LP DCP is a leading energy infrastructure firm. DCP’s third-quarter adjusted earnings of $1.50 per unit beat the Zacks Consensus Estimate of $1.05.

DCP Midstream is expected to see an earnings surge of 181% in 2022. The company currently has a Zacks Style Score of A for Growth and Value. DCP generated an excess free cash flow of $52 million in the third quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance