Energizer Holdings (NYSE:ENR) Is Due To Pay A Dividend Of $0.30

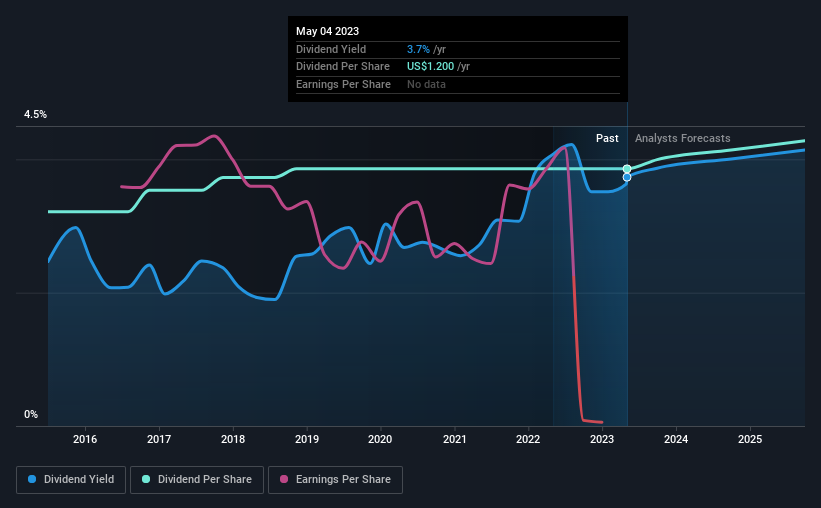

Energizer Holdings, Inc. (NYSE:ENR) has announced that it will pay a dividend of $0.30 per share on the 13th of June. This makes the dividend yield 3.7%, which will augment investor returns quite nicely.

View our latest analysis for Energizer Holdings

Energizer Holdings Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Energizer Holdings is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share could fall by 28.5% over the next year if the trend of the last few years can't be broken. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

Energizer Holdings Is Still Building Its Track Record

It is great to see that Energizer Holdings has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2015, the annual payment back then was $1.00, compared to the most recent full-year payment of $1.20. This implies that the company grew its distributions at a yearly rate of about 2.3% over that duration. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Earnings per share has been sinking by 29% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Energizer Holdings' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Energizer Holdings' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Energizer Holdings has 2 warning signs (and 1 which can't be ignored) we think you should know about. Is Energizer Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance