Energizer (ENR) Q1 Earnings & Sales Miss Estimates, Down Y/Y

Shares of Energizer Holdings, Inc. ENR fell 4.9% during trading hours on Feb 6, following soft first-quarter fiscal 2023 results. Both the top and the bottom line missed the Zacks Consensus Estimate and decreased year over year.

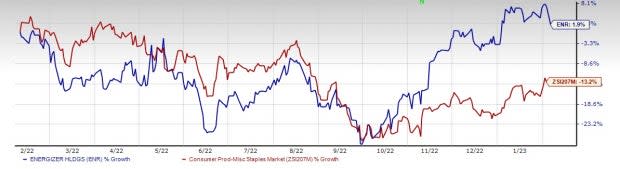

ENR’s shares have increased 1.9% in the past year compared with the industry’s 13.2% decline.

Q1 Metrics

Energizer’s adjusted earnings of 72 cents per share missed the Zacks Consensus Estimate by a penny and plunged 30.1% from the year-ago fiscal quarter’s reported figure. The bottom line has also missed our consensus estimate of 75 cents a share.

Image Source: Zacks Investment Research

ENR reported net sales of $765.1 million, falling short of the Zacks Consensus Estimate of $786 million and our estimate of $790 million. The top line also decreased 9.6% from the year-ago fiscal quarter’s reading. Organic sales fell 5.4% in the quarter under review, driven by weak volumes stemming from the timing of holiday orders in the battery business, and category declines from increased retail pricing and retailer inventory management. We note that management exited certain low-margin profile battery customers and products, which further contributed to the decline. However, strength in the global pricing actions partly offset the decrease.

Segments in Detail

On Oct 1, 2021, Energizer changed its segments from the two geographies of Americas and International to two reporting units, namely Battery & Lights and Auto Care. The move followed the acquisition of Spectrum Brands’ Battery and Auto Care units in the first quarter of fiscal 2022.

Energizer’s Batteries & Lights segment’s revenues dipped 9.3% year over year to $671.6 million in first-quarter fiscal 2023 and lagged the consensus mark of $690.6 million. Meanwhile, revenues in the Auto Care segment decreased 11.9% to $93.5 million and came below the consensus mark of $99.4 million.

Energizer Holdings, Inc. Price, Consensus and EPS Surprise

Energizer Holdings, Inc. price-consensus-eps-surprise-chart | Energizer Holdings, Inc. Quote

Margins

In the fiscal first quarter, Energizer’s adjusted gross margin expanded 150 basis points (bps) to 39%. This was mainly backed by continued gains from the pricing initiatives, Project Momentum savings of $6.5 million and favorable impact from exiting lower-margin businesses. Increased operating expenses including material and ocean freight costs, the inflationary trends and currency headwinds partly offset the increase.

Excluding restructuring costs, this Zacks Rank #4 (Sell) company’s adjusted SG&A as a rate of sales was 14.9% compared with 13.2% recorded in the prior-year quarter. On a dollar basis, SG&A rose about 2.2% to $114.1 million, driven by increased stock-compensation amortization, factoring fees and higher depreciation expenses. This was somewhat offset by Project Momentum savings and favorable currency impacts. Adjusted EBITDA was $145.6 million, down 10% year over year.

Other Financial Details

As of Dec 31, 2022, Energizer’s cash and cash equivalents were $280.3 million, with long-term debt of $3,506.6 million and shareholders' equity of $130.8 million. During the fiscal first quarter, ENR paid over $50 million of debt. In the reported quarter, it paid a dividend of nearly $21.8 million.

The operating cash flow for the reported quarter was $161 million and the free cash flow was $152.2 million.

Outlook

We note that Project Momentum is on track, delivering savings of about $7 million in the fiscal first quarter. It anticipates generating overall project savings of $30-$40 million for the full year. The one-time project expenses for the current fiscal year are likely to be in the bracket of $25-$35 million and capital expenditures of $15-$20 million. The company is on track to generate total savings and one-time expenses over the life of the program.

Management reiterated guidance for fiscal 2023. Energizer projects organic revenues to grow in low-single digits for the current fiscal year. It expects low single-digit declines for reported revenues, including currency headwinds of roughly $50 million. It expects currency headwinds on pre-tax earnings of about $20 million and 23 cents per share, based on the current rates.

Adjusted EBITDA is forecast in the $585-$615 million band. Management envisions adjusted earnings per share of $3-$3.30 for the current fiscal year.

Three Better-Ranked Consumer Staples Stocks

Some better-ranked stocks in the Consumer Staples sector are Lamb Weston LW, MGP Ingredients MGPI and Edgewell Personal Care EPC.

Lamb Weston, a global manufacturer and distributor of value-added frozen potato products, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales suggests growth of 19.6% from the year-ago reported number. LW has a trailing four-quarter earnings surprise of 52.6%, on average.

MGP Ingredients, which produces and markets ingredients and distillery products, currently carries a Zacks Rank #2 (Buy). MGPI has a trailing four-quarter earnings surprise of 36.3%, on average.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings per share suggests growth of 7.3% and 6.2%, respectively, from the corresponding year-ago reported figures.

Edgewell Personal Care, which manufactures personal care products, currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for EPC’s current financial-year sales suggests 2.5% growth from the year-ago period’s reported figure. Edgewell Personal Care has a trailing four-quarter earnings surprise of 4.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

Edgewell Personal Care Company (EPC) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance