Encore Wire, the Prysmian Buyout and Next Picks

On April 15, Encore Wire Corp. (NASDAQ:WIRE), a small-cap copper wire and cable manufacturer, announced a merger with Prysmian SpA (MIL:PRY), a Milan, Italy-based cable manufacturer and installer traded on the Borsa Italiania exchange. Under the agreement, Encore shareholders will receive $290 per share in cash, an approximate 20% premium to the 30-day volume-weighted share price as of April 12.

At the time of the announced acquisition, Prysmian Chief Executive Massimo Battaini exclaimed:

"The acquisition of Encore Wire represents a landmark moment for Prysmian and a strategic and unique opportunity to create value for our shareholders and customersThrough this acquisition, Prysmian will grow its North American presence, enhancing its portfolio and geographic mix, while significantly increasing the exposure to secular growth drivers. We look forward to welcoming the Encore Wire team to Prysmian and benefiting from the combined company's enhanced product offerings and customer relationships."

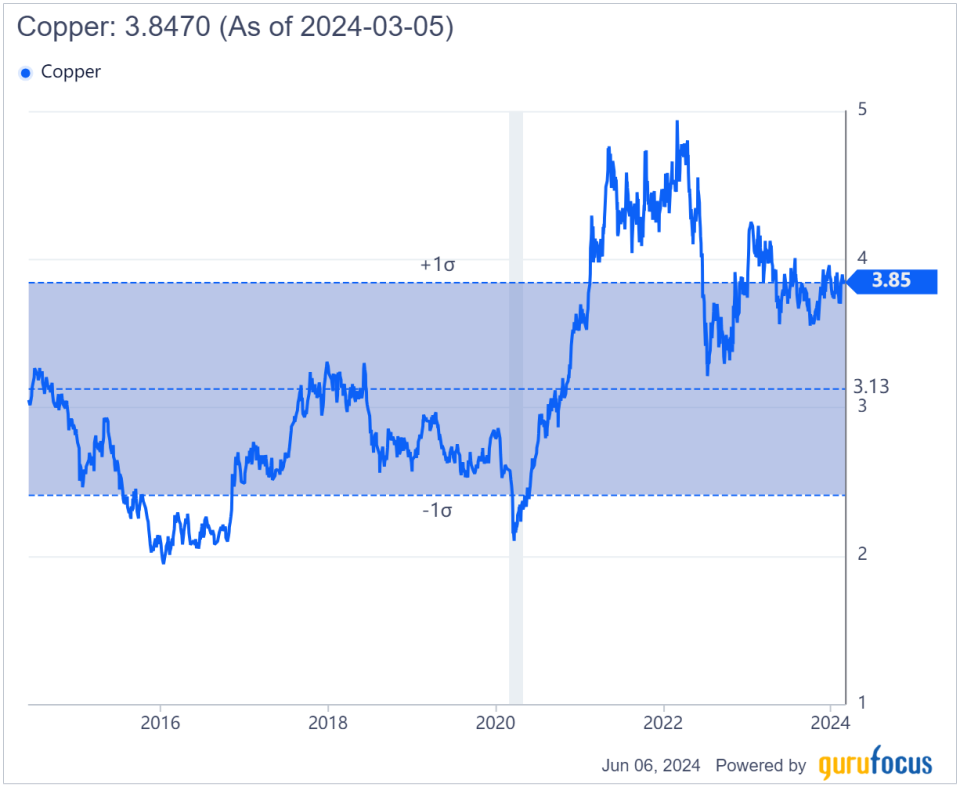

I purchased shares of Encore at the beginning of the third quarter last year and since that time, shares have increased in value by over 50%. Encore Wire operates in the electrical components and equipment sub-industry in the industrial sector. I discovered Encore while doing a stock screen search and as I recall the thing that most impressed me was the company had no debt in addition to meeting most of my screening criteria. At the time I purchased shares, the company had a return on assets of 28.80%, invested capital (ROIC) of 30.9% and an enterprise value/Ebitda ratio of 3.39. The company is also tied to the copper commodity market, which has had rapidly increased demand over the last decade due to global pursuit (especially in China) of electrification and sustainable energy sources. Copper is especially appealing as it has good conductivity, ductility and recyclability, making it an all-star application for sustainable energy.

Shares during that time looked promising, but although the share price kept rising, total returns stayed flat and quarterly revenues and margins have consistently declined due to high reductions in sale prices of copper wire compared to copper commodity prices, which peaked annually at the end of 2021, fell by over 14% in 2022 and has been steadily increasing since that time. Lower margins during 2023 were also attributed to a suppressed availability of skilled labor.

To preserve shareholder value during the year, management actively engaged in stock buybacks. As stated by Bret Eckert, Encore's executive vice president and chief financial officer, during the fourth-quarter 2023 conference call:

"During the quarter, we repurchased 476,300 shares of our common stock for a total cash outlay of $85.1 million. Since the first quarter of 2020, we have repurchased 5,634,069 shares of our common stock and have returned almost $785 million in capital to shareholders through share repurchases and dividends."

The board has approved the repurchase of up to 2 million shares of the company's common stock through March 31, 2025.

Since the merger announcement, Encore's stock price has been flat, and the company did not engage in any repurchases during the first quarter. This year, the average selling price of copper wire per pound has decreased by 16.20% compared to the same period in 2023. The average cost of copper per pound purchased has decreased by 5%.

Management also did not host an earnings call after the first-quarter results and Encore is expecting the merger to be completed in the second half of this year.

What's next for Encore investors?

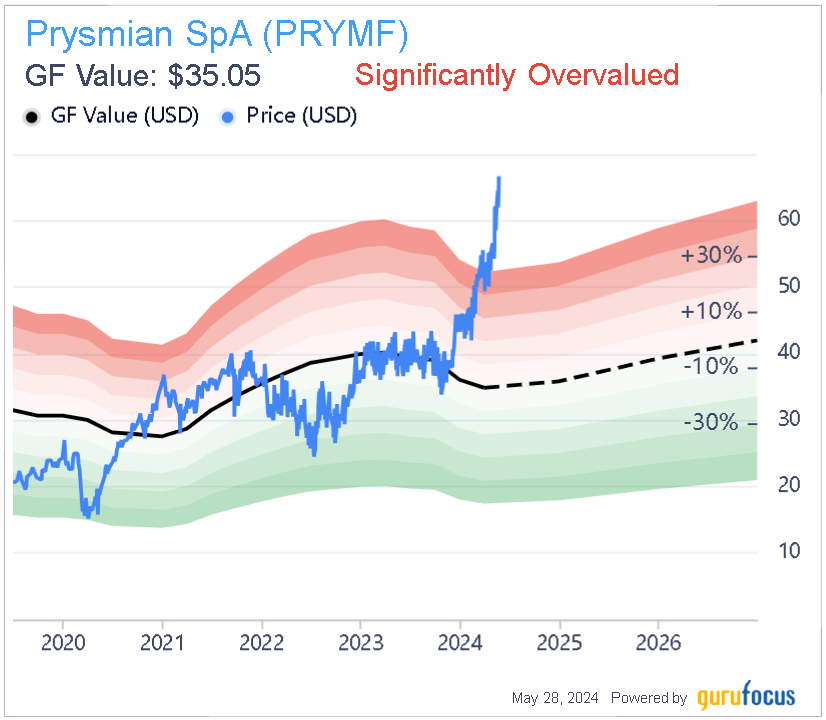

Although the pending buyout is not without risks, I consider my purchase of Encore Wire as a win, but I wish I had bought into the equity sooner. Of course, hindsight is 20/20, so where do we go from here? Prysmian is available through over-the-counter American depositary receipts, but not traded directly through U.S. exchanges. Although Prysmian CEO Massimo Battaini is excited about anticipated synergies with Encore, from a value perspective, the company's investment prospects may give investors pause as the business is significantly overvalued with a current price-earnings ratio of 33.01 and a weighted average cost of capital that exceeds the ROIC by 3.69%, indicating eroding shareholder value.

Artificial intelligence has driven demand for efficient energy sources, so investors would be savvy to explore companies that are tied to the copper market and production of energy conductor products used in data centers. Unfortunately, Wall Street sentiment has been bullish in these areas, so finding bargains is tough, but investors may want to watchlist the following:

Preformed Line Products (NASDAQ:PLPC): This is an Ohio-based micro-cap that specializes in optical ground wire products and provides outside plant closures to protect and support wireline and wireless networks, such as copper cable or fiber optic cable. Throughout 2023, the company had consistent revenue and net income growth and triple-digit operating cash flow growth. The company has a respectable ROIC above 10% and an enterprise value/Ebitda ratio below 10. Reported revenue and earnings have receded during the first quarter of 2024 and demand for the company's products appears to be softening The stock is currently trading significantly higher than the GF Value of $95.78, so waiting for a pullback would be in investors' best interest.

Belden Inc. (NYSE:BDC):This is a Missouri-based mid-cap manufacturer of signal transmission solutions consisting of two operating segments:

Enterprise Solutions offers copper and fiber cable solutions, interconnect panels, racks and signal extension systems for applications like local area networks, data centers and building automation.

Industrial Automation Solutions provides network infrastructure and digitization solutions for industries and infrastructure, covering data handling, acquisition and management.

Belden had strong 2023 quarterly ROIC ratios consistently above 10%, quarterly operating cash flow growth ranging from 15% to 45% and quarterly free cash flow growth ranging from 13% to 63%. 2023 quarterly EV/Ebitda ratios hovered around 10, but ROAs ranging from 7% to 9% were far below my preferred level of 25% or above. Free cash flow yield has been consistently above 4% for this company. There are signs the company's markets are softening as revenue and earnings have decreased during the last two quarters. Another major concern is the company's quarterly debt-to-equity ratios have consistently exceeded 1 since October 2022. The company's current ROIC exceeds its WACC by 1.82%, indicating a very slight increase in shareholder value. Belden is facing headwinds due to drops in sales volume and lower copper prices, but analysts expect stronger results during 2025. GuruFocus has currently valued this stock below its current price of $94.41, so again, this stock appears to be another watchlist contender.

Atkore Inc. (NYSE:ATKR): This Illinois-based small-cap manufactures a range of electrical, mechanical, safety and infrastructure products and solutions both in the U.S. and internationally, through two operating segments:

The Electrical segment includes conduits, cables, plastic pipes and other electrical accessories.

The Safety & Infrastructure segment includes protection and reliability solutions for critical infrastructure, such as metal framing, mechanical pipe systems, perimeter security and cable management systems.

This stock has very attractive financial efficiency ratios with quarterly ROIC and ROA consistently above 26% and 21% since the second half of 2021. Operating margins ranged from 20% to 32%, and free cash flow margin ranged from 12% to 22% during the same period. On the flipside, revenue and earnings have declined since 2022 due to softer demand for Atkore's PVC products targeted toward the telecom industry and slowed customer investments toward 5G infrastructure. Long term, the business looks more promising as Atkore is adapting to demand changes by focusing more heavily on the electrical infrastructure markets that target customers in data center and artificial intelligence spaces. The company has a healthy debt-to-equity ratio of 0.58 and its ROIC exceeds its WACC by 11% for the latest quarter, indicating the stock is increasing in shareholder value. The company has also consistently repurchased shares and declared its first dividend for the first quarter of 2024. Atkore has some attractive valuation ratios for EV/Ebitda at 6.61 and a PEG of 0.19. The company has a GF Value Rank of 5 out of 10 and a GF Score of 91 out of 100. Of these three comparison stocks, this stock appears to have the most appealing price point currently.

Fundamental comparisons

Ticker Symbol | WIRE | PRYMY | PLPC | BDC | ATKR |

Size | Small-Cap | Mid-Cap | Micro-Cap | Small-Cap | Small-Cap |

Analyst Rating | Hold | Buy | Buy | Hold | Buy |

Forward PE | 14.52 | 20.32 | NA | 16.17 | 9.08 |

PEG | .24 | 1.28 | .63 | 2.29 | .19 |

EV/EBITDA | 9.55 | 7.06 | 7.46 | 11.97 | 6.62 |

Debt/Equity | -- | .73 | .16 | 1.12 | .58 |

ROA % | 15.8 | 3.98 | 5.53 | 6.91 | 21.54 |

ROIC % | 17.44 | 7.86 | 10.57 | 11.42 | 29.06 |

WACC % | 12.89 | 11.49 | 8.54 | 9.56 | 13.51 |

Operating Margin % | 14.96 | 6.54 | 10.4 | 11.35 | 22.95 |

Dividend Yield % | .03 | 1.15 | 1.46 | .21 | .86 |

Buyback Yield % | 12.12 | 0 | 1.84 | 4.99 | 6.93 |

FCF Yield % | 5.42 | 5.43 | 9.64 | 5.92 | 7.91 |

Conclusion

To summarize, anyone who bought into Encore Wire before 2022 is likely happy with the proposed merger and will have some additional cash to invest during the latter part of this year; however, there may be better options than reinvesting in the company through its new parent. The three additional equities described also stand to capitalize on the growing demand for copper and sustainable energy sources. Of the three featured above, Atkore looks like the one to move to the top of a watch list.

Please note that I am not a financial advisor, and this article is intended only for informative purposes and should not be construed as investment advice.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance