1 in 5 Aussies could lose jobs in ‘worst economic downturn in history’

Australia is facing “one of the largest drops in economic activity – perhaps the largest – in its history,” and it means about a fifth of Australians could be out of a job.

That’s according to think tank Grattan Institute, which has released a working paper on the scale of Covid-19’s impact on Australia’s employment, which estimates between 14 and 26 per cent of Australians will be out of a job due to Australia’s lockdown and social distancing measures.

“In February 2020, 13.01 million people in Australia were employed – so 3.43 million Australians could lose work,” wrote report authors Brendan Coates, Matt Cowgill, Will Mackey and Tony Chen.

“Some may quickly return as spatial distancing measures are relaxed, but a shock to employment of this size and speed is unprecedented in Australia.”

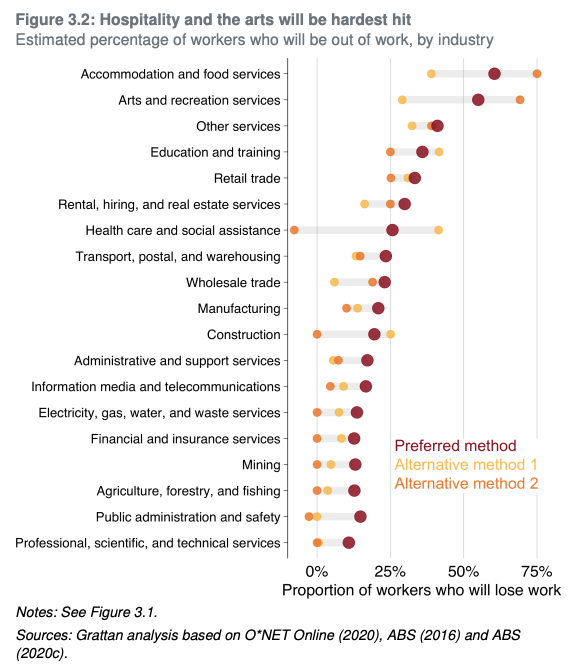

The jobs hardest-hit from the coronavirus

The hardest-hit sectors will include the hospitality industry, with about two-thirds of these employees estimated to be out of a job. Moreover, many of these workers won’t be eligible for JobKeeper as they are short-term casual workers who have been employed under a year.

The hospitality industry is closely followed by the arts and recreation services, with the education and training sector and retail trade sector also expected to see more than 25 per cent of workers out of a job.

Younger workers will be more affected than older workers, and lower-income earners twice as likely to be unemployed as high-income earners: 40 per cent of those earning between $1 to $149 a week will be out of a job, while roughly 17 per cent of those earning $3,000 or more a week will lose work.

Jobless rate to hit nearly 10%: optimistic estimates

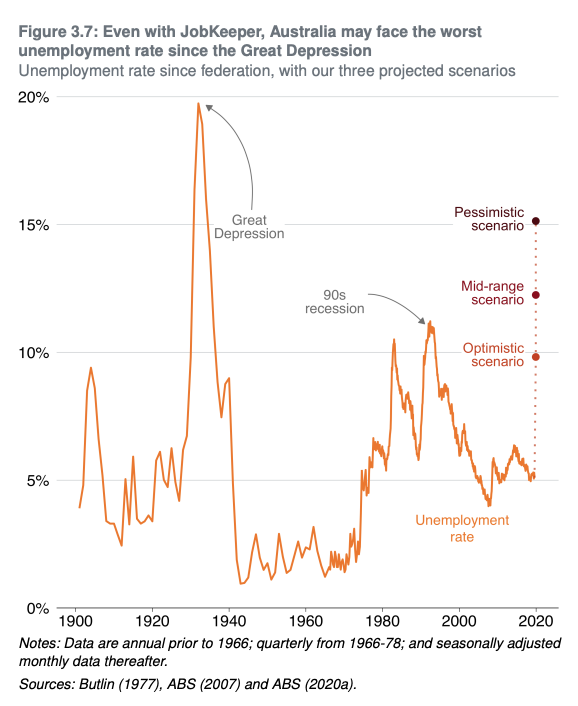

According to Grattan Institute estimates, if all 3.43 million Australians were classified as unemployed, the jobless rate would rise to 30.2 per cent – but this figure will be tempered by the number of people on JobKeeper wage subsidy payments, who will still be on the books as employed.

The think tank created three unemployment scenarios: a pessimistic scenario, an optimistic scenario, and a mid-range scenario.

The pessimistic scenario would see the unemployment rate hit 15.1 per cent, while the mid-range scenario estimates this number would be around 12.2 per cent – the worst rate seen since the 1930s’ Great Depression.

Even under optimistic estimates, the jobless rate would fall to 9.8 per cent. “But even this would be the worst unemployment rate in Australia for nearly three decades,” the report stated.

Aftershocks will linger

The economic fall-out of the coronavirus will be felt for a long time, the economists warned.

“History tells us that recovery from periods of high unemployment is rarely fast.

“When the unemployment rate rises in an economic downturn, it typically takes about two or three times as long to recover as it did to reach the worst point.”

While this crisis looks different, and there is a lot of “pent-up” consumer spending that could be unleashed after the shutdown period, the impact will likely linger for some time yet.

“The big risk remains that a sustained shutdown will have long-lasting impacts on the economy and employment. The longer the downturn goes, and the worse it gets, the less likely the labour market, and the economy more broadly, can spring back to a healthy state on the other side.”

More stimulus needed

While the government has already dedicated a significant sum of nearly $200 billion to the economy to prop up businesses and households during the shutdown, we may need more even when the coronavirus crisis is over, the authors said.

“Direct cash transfers to households could boost spending, accelerating the pace of the economic recovery.

“Failing to provide that support will condemn many Australians to a long and deep recession, harming their long-term economic potential. A deep recession will also worsen governments’ budgetary positions.”

White collar firms lead demand for JobKeeper

Figures from the Australian Taxation Office have revealed that more than 800,000 sole traders and firms have applied for the $1,500 JobKeeper wage subsidy.

But the data also reveals a surprising detail: the industry that has indicated the most interest in applying for the replacement wage are those in the professional, scientific and technical services sector, or more than 120,000 lawyers, barristers, accountants and management consultants, according to news.com.au.

This is followed by those in the construction sector.

Well over half (62 per cent) of businesses interested in JobKeeper come from NSW (35 per cent) and Victoria (27 per cent), followed by Queensland (19 per cent). Only 1 per cent of likely claims come from the ACT or Northern Territory.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance