EML Payments (ASX:EML) shareholders have endured a 76% loss from investing in the stock three years ago

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of EML Payments Limited (ASX:EML), who have seen the share price tank a massive 76% over a three year period. That would certainly shake our confidence in the decision to own the stock. Furthermore, it's down 28% in about a quarter. That's not much fun for holders.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for EML Payments

EML Payments isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, EML Payments saw its revenue grow by 17% per year, compound. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 21% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

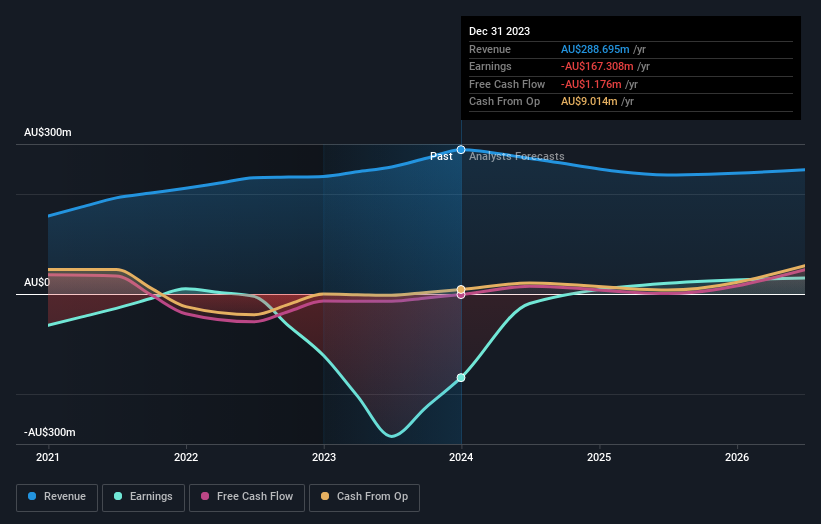

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for EML Payments in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that EML Payments has rewarded shareholders with a total shareholder return of 45% in the last twelve months. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You could get a better understanding of EML Payments' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance