Embraer (ERJ) Q1 Loss Wider Than Expected, Revenues Up Y/Y

Shares of Embraer SA ERJ decline 3.6% to reach $11.31 on Apr 29, reflecting investors’ skepticism following its first-quarter 2021 results.

The company incurred first-quarter 2021 adjusted loss of 52 cents per American Depository share (ADS), wider than the Zacks Consensus Estimate of a loss of 33 cents but narrower than the year-ago quarter’s loss of 57 cents.

Including one-time items, the company incurred a GAAP loss of 49 cents per share compared with a loss of $1.59 in the year-ago quarter.

Revenues

Embraer’s first-quarter revenues came in at $807.3 million, up 27.4% year over year. The increase in revenues was due to growth in the Commercial Aviation, Defense & Security and Executive Aviation segments.

Order and Delivery

Embraer delivered 22 jets in the reported quarter, down 36.4% year over year. The company delivered nine commercial and 13 executive (10 light and three large) jets compared with five commercial and nine executive (five light and four large) jets in the year-ago quarter.

Backlog at the end of the quarter was $14.2 billion compared with $15.9 billion in the prior quarter.

Operational Highlight

In the first quarter, the company’s cost of sales and services totaled $730.9 million, up from $449.8 million in the prior-year quarter.

Consequently, Embraer’s gross profit plunged 58.5% to $76.4 million.

It posted quarterly adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $18 million compared with $64.9 million in the year-earlier quarter.

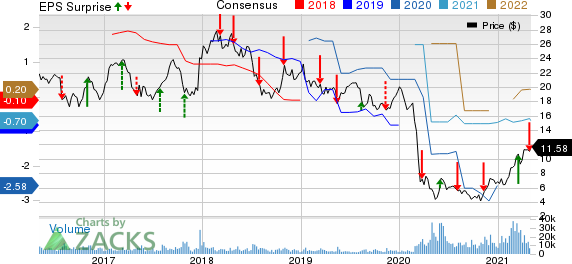

EmbraerEmpresa Brasileira de Aeronautica Price, Consensus and EPS Surprise

EmbraerEmpresa Brasileira de Aeronautica price-consensus-eps-surprise-chart | EmbraerEmpresa Brasileira de Aeronautica Quote

Financial Update

As of Mar 31, 2021, the company’s cash and cash equivalents amounted to $1,123.2 million compared with $1,883.1 million as of Dec 31, 2020.

Embraer had net debt of $1,902.2 million as of Mar 31, 2021, up from $1,695.7 million as of Dec 31, 2020.

Adjusted net cash used in operating activities was $414.5 million at the end of first-quarter 2021 compared with $593.3 million at first-quarter 2020-end.

The company’s adjusted free cash outflow at the end of the first quarter was $226.6 million compared with free cash outflow of $676.6 million at the end of 2020’s first quarter. The improvement was primarily attributable to the steps taken to stabilize production and operations amid the COVID-19 pandemic

Guidance

Due to uncertainties related to the impact of the spread of COVID-19, Embraer has kept its 2021 guidance suspended for the time being.

Zacks Rank

Embraer currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corp. LMT reported first-quarter 2021 earnings of $6.56 per share, which surpassed the Zacks Consensus Estimate of $6.32 by 3.8%.

Hexcel Corporation HXL reported first-quarter 2021 loss of 10 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 16 cents.

Raytheon Technologies Corporation’s RTX first-quarter 2021 adjusted earnings per share of 90 cents outpaced the Zacks Consensus Estimate of 88 cents by 2.3%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

EmbraerEmpresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance