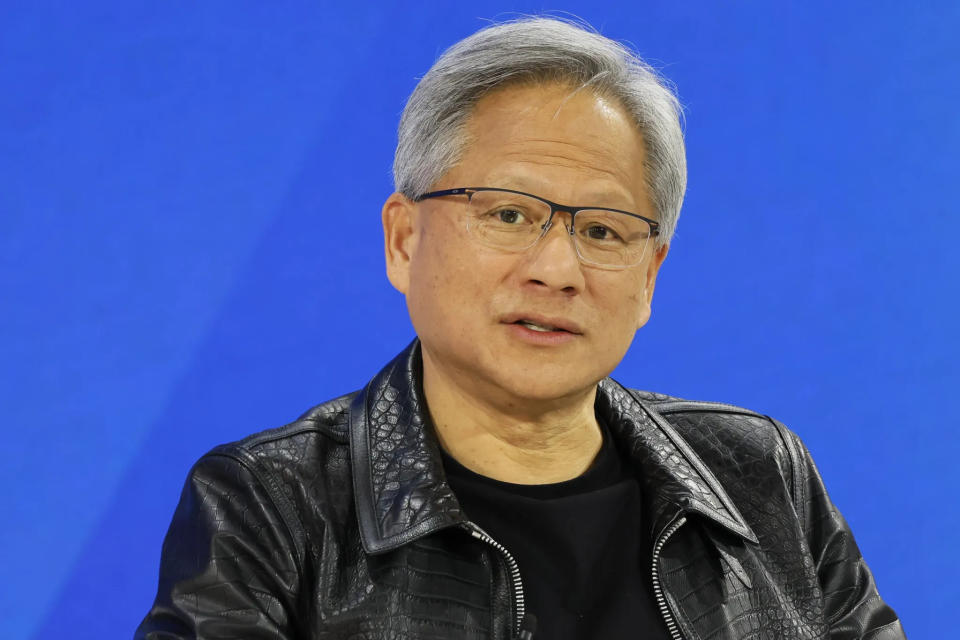

Elon Musk earns praise from Nvidia co-founder Jensen Huang ahead of shareholder vote on pay package—‘Tesla is far ahead in self-driving cars’

Nvidia’s star founder Jensen Huang endorsed Tesla’s strategy for AI-enabled autonomous vehicles weeks ahead of a key vote that determines if CEO Elon Musk receives his record compensation.

Musk is all but betting the company on his recent pivot to AI, having quietly scuppered his vision of growing volumes more than tenfold to 20 million vehicles a year by 2030—as much as Toyota and Volkswagen sell combined.

“Tesla is far ahead in self-driving cars,” Huang attested to in an interview with Yahoo Finance uploaded to YouTube late last week.

The AI pivot is controversial since it moves Tesla further away from its stated mission of accelerating the global transition to sustainable transportation. And while Musk’s so-called “supervised Full Self-Driving” may be the best-known advanced driver assist system (ADAS) on the market, few customers saw the value of plunking down $15,000 for a system that would require them to babysit their car as it attempts to navigate city streets.

As a result, Musk's been forced to slash the price back down to $8,000, the level it was when he first launched FSD beta in October 2020.

High quality endorsement

An endorsement from the likes of Huang, whose draw at developer conferences now fill entire stadiums, could go a long way in assuaging investor concerns he himself might have veered off course.

“The technology is really revolutionary and the work that they’re doing is incredible,” the Nvidia boss continued.

What is this a rock concert? No it’s the Jensen Huang keynote at @nvidia’s #GTC24. Wow, what a difference a few years makes! pic.twitter.com/RqsiOg6Q2D

— Bob O'Donnell (@bobodtech) March 18, 2024

In a couple of weeks, shareholders are due to vote a second time on Musk's record pay package—worth roughly $55 billion at the current stock price—after a Delaware court in January voided the original 2018 vote for procedural reasons related to the quality of Tesla’s governance.

With proxy advisors like Glass Lewis now recommending that investors vote against approving Musk's pay, the outcome of the June 13 annual meeting is proving tighter than expected.

A vote of confidence in his new AI strategy from someone like Huang could boost his chances. Few businessmen are as respected as Huang, who founded Nvidia and managed its exponential growth over recent years thanks to a prescient bet on repurposing graphic processors to train AI models like OpenAI’s flagship GPT-4o.

Musk and Tesla gobbling up Nvidia AI chips at record pace

Huang praised the twelfth and latest version of Tesla’s Full Self-Driving (FSD) software, which abandoned the previous approach of hard-coding commands in computer language in favor of relying solely on an AI-enabled neural network.

“It learns from watching videos,” Huang said. “This technology is very similar to the technology of large language models, but it requires just an enormous training facility and the reason for that is because the data rate of video, the amount of data, is so, so high.”

https://www.youtube.com/watch?v=ER7iqeYx9HU

That said, Huang also knows how important Tesla is as a client. Musk is a voracious customer of Nvidia’s AI training chips, more than doubling his compute capacity just in the first quarter over the final three months of last year.

During that period Tesla spent the staggering sum of $1 billion to build out its AI infrastructure, and that’s just the beginning. Tesla forecasts its compute capacity equivalent to 35,000 GPU clusters should hit 85,000 by year’s end, by which point it may have spent $10 billion.

To afford that kind of investment at a time when its core car business needs to keep offering margin-eroding incentives to keep sales from cratering, Musk is willing to go to almost any length to cut costs elsewhere.

He has already sacked thousands of employees, fired the team behind his industry-leading Supercharger network and scrapped plans to invest in all-new assembly lines for its a upcoming $25,000 entry model, now widely expected to be a Model 3 hatchback.

But if it helps Tesla hold onto its leadership in the EV industry—and make Musk $55 billion wealthier in the process—those sacrifices may not have been in vain.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance