Element Solutions (ESI) Scales 52-week High: What's Driving It?

Element Solutions Inc’s ESI shares reached a fresh 52-week high of $27.08 on Jun 13, before closing at $26.75.

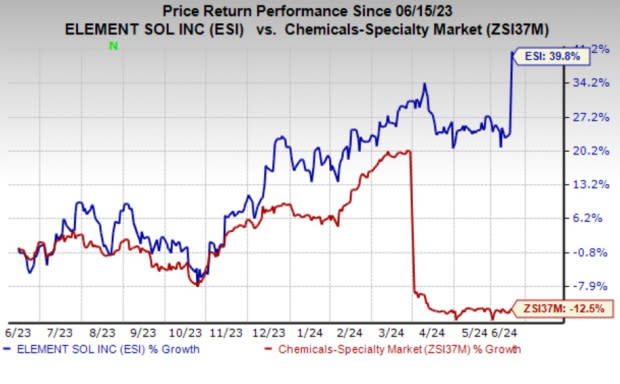

In the past year, the stock has surged 39.8% against the industry’s 12.5% decline in the same period.

Image Source: Zacks Investment Research

What’s Driving Element Solutions?

Element Solutions has recently increased its guidance for the second quarter and full-year 2024. The company now anticipates an adjusted EBITDA of approximately $135 million for the second quarter, up from the previously expected $125 million.

This optimistic outlook is driven by strong performance in its electronics business, with notable improvements and accelerated profitability in certain areas. Growth in the wafer-level packaging and circuitry segments has supported significant customer expansion over the past two months. While some segments of the electronics market show signs of recovery, overall unit and chemistry volumes remain below long-term trends.

Despite this, Element Solutions expects to achieve record adjusted EBITDA in 2024, the highest since its inception in 2019, bolstering confidence in its long-term growth potential. The company has increased its 2024 adjusted EBITDA forecast from a range of $515 million to $530 million to a revised range of $530 million to $545 million. The company also projects 2024 adjusted earnings per share (EPS) between $1.40 and $1.46.

In the first quarter of 2024, Element Solutions reported adjusted EPS of 34 cents, which surpassed the Zacks Consensus Estimate of 32 cents. The company achieved net sales of $575 million, which remained flat year over year and fell short of the Zacks Consensus Estimate of $601.8 million. Organic net sales increased 1%, while adjusted EBITDA grew 13% year over year to $127 million.

During the first quarter, the company experienced a recovery in electronics markets. Investments in high-value technologies resulted in a favorable product mix, and continued pricing actions amid declining raw materials prices led to higher margins in the industrial business. Net sales in the Electronics segment increased 3% year over year to $349 million, with organic net sales rising 4% compared to the previous year.

Element Solutions has a trailing four-quarter average earnings surprise of 3%. The Zacks Consensus Estimate for 2024 EPS is pinned at $1.38, indicating a 7% increase from the previous year’s levels.

Element Solutions Inc. Price and Consensus

Element Solutions Inc. price-consensus-chart | Element Solutions Inc. Quote

Zacks Rank & Key Picks

ESI currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, ATI Inc. ATI and Ecolab Inc. ECL. While Carpenter Technology sports a Zacks Rank #1 (Strong Buy) at present, ATI and Ecolab carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $4.31, indicating a year-over-year rise of 278%. CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 101.2% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 8.34%, on average. The stock has surged 44.4% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 32.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance