Electronics Stocks' Oct 30 Earnings Roster: KLAC, TEL & More

Electronics stocks' quarterly releases are expected to reflect the ongoing technical advancement in the Internet infrastructure and telecommunication sector globally. Further, accelerated deployment of 5G technology is expected to have driven the industry participants’ performance in the quarter under review.

This was evident from Teradyne’s TER third-quarter results. The company witnessed year-over-year growth in both earnings and revenues driven by continued growth in 5G infrastructure and flash memory test spending.

However, electronic companies have significant exposure to the semiconductor industry, which is facing softness thanks to declining memory prices, lower chip demand from smartphone OEMs and imposition of tariffs owing to the U.S.-China trade war.

Further, suspension of shipments to Huawei on account of the export ban imposed by the U.S. government is expected to have affected the quarterly results of the electronics stocks.

These factors were reflected in recently announced quarterly releases of Flex FLEX and Fortive FTV.

Flex’s second-quarter fiscal 2020 results bore the brunt of sluggish demand from China, soft demand from networking customers and weakness in semiconductor capital equipment vertical.

Meanwhile, Fortive’s third-quarter 2019 results were hurt by Huawei ban.

Growth Drivers Plenty

IoT supported industrial automation, rising demand for connected appliances in consumer market and growing proliferation of positioning, surveying and machine control products are likely to have aided electronics companies in the quarter under review.

Moreover, increasing usage of electronic components in smart cars and autonomous vehicles is likely to have benefited these stocks in third-quarter 2019. Also, growing adoption of AR/VR devices, AI, ML, cloud computing and IoT services are expected to have contributed to the quarterly results.

Additionally, rapid adoption of smartwatches and wearables, which are comprised of fitness tracking components, is likely to have bolstered demand for the products offered by electronics companies.

Sneak Peek on Upcoming Releases

In this backdrop, let’s see how the following electronics stocks are poised ahead of quarterly results scheduled on Oct 30.

KLA-Tencor’s KLAC fiscal first-quarter 2020 results are likely to reflect the positive impact of its strong efforts in bringing EUV lithography technology to the market. Further, growing Foundry and Logic investments are expected to have driven the company’s first-quarter top line.

Moreover, next-generation technology development, capacity additions at leading-edge nodes, and investment in EUV infrastructure are likely to have contributed to the first-quarter performance. (Read more: KLA-Tencor (KLAC) to Post Q1 Earnings: What’s in the Cards?)

However, weakness in the memory segment is expected to have negatively impacted the company’s revenues in the to-be-reported quarter.

Notably, the Zacks Consensus Estimate for earnings has been stable over the past 30 days at $2.20.

KLA is unlikely to deliver a positive earnings surprise. This is because per the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of a beat.

KLA has an Earnings ESP of 0.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

KLA-Tencor Corporation Price and EPS Surprise

KLA-Tencor Corporation price-eps-surprise | KLA-Tencor Corporation Quote

TE Connectivity’s TEL fiscal fourth-quarter 2019 results are likely to reflect its strength in aerospace, defense and medical fields. Further, its well-performing aerospace, defense and marine business is expected to have driven the industrial segment’s performance in the quarter under review.

Content growth in automobile production is anticipated to have positively impacted the fourth-quarter performance. (Read more: TE Connectivity (TEL) to Post Q4 Earnings: What's in Store?)

However, weak market conditions in China and softness in European Auto market are likely to have affected the fourth-quarter results.

Notably, the Zacks Consensus Estimate for earnings has moved north by 0.8% to $1.31 over the past 30 days.

TE Connectivity has an Earnings ESP of +1.15% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

TE Connectivity Ltd. Price and EPS Surprise

TE Connectivity Ltd. price-eps-surprise | TE Connectivity Ltd. Quote

Garmin’s GRMN third-quarter 2019 results are expected to reflect the benefits from its strategy of product introduction, acquisitions and strategic partnerships. The company’s expanding portfolio of wearables and focus on the healthcare market are likely to have positively impacted the fitness segment’s third-quarter performance. (Read more: Garmin (GRMN) to Report Q3 Earnings: What's in the Offing?)

However, weak personal navigation device market is likely to have marred Garmin’s Auto/Mobile segment.

Notably, the Zacks Consensus Estimate for earnings has been stable over the past 30 days at 94 cents.

Garmin has an Earnings ESP of 0.00% and a Zacks Rank #3.

Garmin Ltd. Price and EPS Surprise

Garmin Ltd. price-eps-surprise | Garmin Ltd. Quote

Trimble’s TRMB third-quarter 2019 results are likely to reflect strengthening building and civil construction businesses. Further, robust mapping, navigation and truck routing businesses are expected to have contributed the third-quarter top line.

However, U.S.-China trade tensions, which are resulting in slowdown in OEM demand and sluggish spending by U.S. farmers, are anticipated to have negatively impacted the company’s agriculture business in the third quarter.

Notably, the Zacks Consensus Estimate for earnings has been stable over the past 30 days at 47 cents.

Trimble has an Earnings ESP of 0.00% and a Zacks Rank #3.

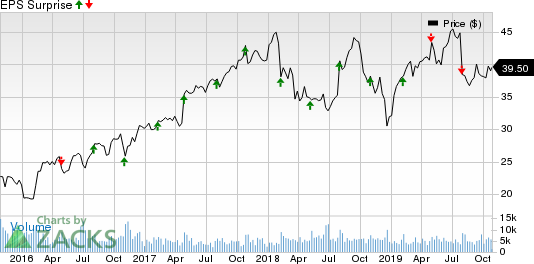

Trimble Inc. Price and EPS Surprise

Trimble Inc. price-eps-surprise | Trimble Inc. Quote

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Trimble Inc. (TRMB) : Free Stock Analysis Report

KLA-Tencor Corporation (KLAC) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

Teradyne, Inc. (TER) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance