What the by-election results mean for our economy

It’s inequality, stupid

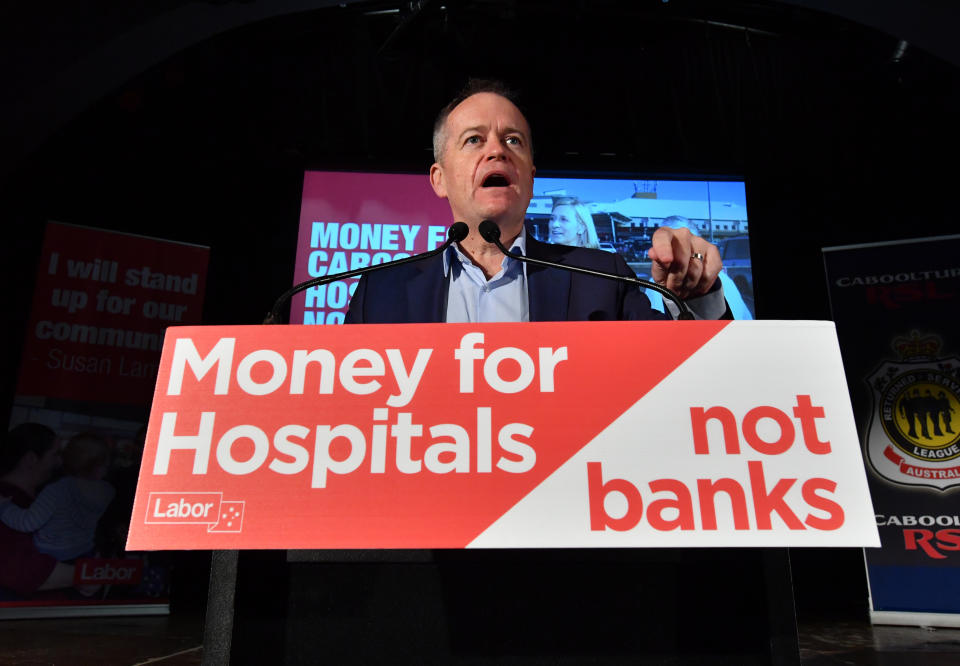

The super-Saturday by-election results over the weekend presented a clear preference from Australian voters – they don’t like policies that increase inequality in society and tax cuts to business are unfair and expensive, draining scares cash from education, heath and other vital services.

Also read: This top performing sector is about to fire up again

In a variance of Bill Clinton’s successful phrase and strategy “it’s the economy, stupid” in winning the 1992 US Presidential election, Labor’s “it’s inequality, stupid” approach to policy is winning it support in the electorate. Or just as accurately, it is the Coalition Government’s policy strategy that increase inequality in society that voters are shying away from.

Credit to the “it’s inequality, stupid” analysis goes to Stephen Moriarty who tweeted that phrase in the aftermath of the by-election results. It summed up the results very well.

Also read: Why SMSF’s could start a housing crash

It has been obvious with the last year of polling and then the by-election results that voters are not happy with the Liberal Party sales pitch which is framed around a story of a growing economy and the promise of income and company tax cuts. This is because economic growth is not all that impressive, despite the government’s rhetoric, and what growth is being registered is skewed heavily towards rising company profits and away from the wage share. Future company tax cuts will only add to that inequality.

Recent cuts to education and the miserable level of the Newstart allowance are the sorts of policies that are compounding unfairness.

Voters instead, are embracing the Labor agenda which promises funding for schools, hospitals, education and training that will be fully funded from tax policy proposals that raise money in what economists call a progressive way – that is, increasing the tax take on those with high incomes and high wealth.

Not giving tax cuts “to the big end of town” as Labor likes to say, by ending the tax distortion of negative gearing for those investing in established dwellings, reducing the capital gains tax concessions and getting rid of excessive dividend imputation refunds raises a lot of revenue and does it in a way that reduces inequality.

Also read: How one woman saved enough on her grocery shop to send her family on a cruise every year

And voters can see this.

They demonstrably like this approach.

The Labor line that pitted “tax cuts for banks and big business versus funding for schools and hospitals” is no socialist plot as some of the more extreme commentators suggest. Rather, it is giving the electorate what they desperately want for their families in a world where job security, genuine cost of living pressures and incomes growth are increasingly fragile.

The policy contrast could be phrased along the lines of what’s the point of having a globally competitive company tax structure if a significant proportion of the population can’t get decent health care, or their kids don’t get great teachers, or are left without an opportunity to pursue a trade or are saddled for a mortgage-like student debt when they finishing the university degree?

Also read: 9 easy ways to avoid failure

It all boils down to the fact that voters are switched on, they do listen and they vote in a way that will best enhance the key aspects of their lives.

In other words, voters only want access to services that make their life better. This is even if they have a pay a bit more tax or miss out on the opportunity to negatively gear an investment property, can’t get huge refunds on holdings of shares that pay fully franked dividends or fiddle their affairs to pay less tax via capital gains.

Labor recognise this and it is why it remains a hot favourite to win the Federal election. It is not clear what the Government can do to change its policy strategy of the last few years without further compromising its credibility.

And when you stop and think about it, what’s wrong with voters wanting good schools for their kids, good health care for their families and a more rapid move to a budget surplus, all paid for by a more progressive tax system?

Yahoo Finance

Yahoo Finance