Edison International (EIX) Q1 Earnings Beat, Sales Rise Y/Y

Edison International EIX reported first-quarter 2022 adjusted earnings of $1.07 per share, which surpassed the Zacks Consensus Estimate of 74 cents by 44.6%. The bottom line also surged 35.4% from the year-ago quarter’s earnings of 79 cents per share.

The company recorded GAAP earnings of 22 cents per share compared with the 68 cents reported in the first quarter of 2021.

Total Revenues

Edison International's first-quarter revenues totaled $3,968 million, which surpassed the Zacks Consensus Estimate of $3,130 million by 26.8%. Also, the top line rose 34.1% from the year-ago quarter’s $2,960 million.

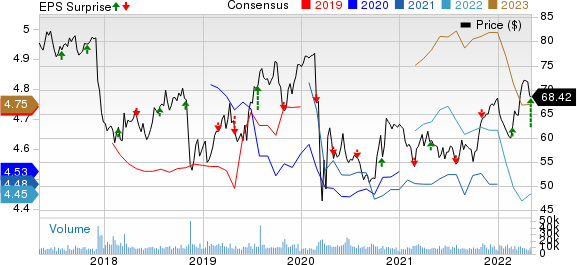

Edison International Price, Consensus and EPS Surprise

Edison International price-consensus-eps-surprise-chart | Edison International Quote

Operational Highlights

In the reported quarter, total operating expenses increased 44.8% year over year to $3,709 million.

Purchased power and fuel costs rose 2.4%, while depreciation and amortization expenses increased 11%.

Operation and maintenance costs increased 76.8% year over year, whereas property and other taxes remained flat with the prior-year quarter figure.

The operating income amounted to $259 million in the first quarter of 2022, which declined by 35.1% from the year-ago quarter.

Segment Results

Southern California Edison’s (SCE) first-quarter adjusted earnings were $1.23 per share compared with 89 cents in the year ago quarter. The increase in SCE’s core earnings can be attributed to higher revenues from the 2021 General Rate Case final decision.

The Parent and Other segment incurred a loss of 16 cents per share compared with the year-ago quarter’s loss of 10 cents. The loss increased primarily due to higher preferred dividends.

Financial Update

As of Mar 31, 2022, Edison International's cash and cash equivalents amounted to $231 million compared with $390 million as of Dec 31, 2021.

The long-term debt was $24.97 billion as of Mar 31, 2022, higher than the 2021-end level of $24.18 billion.

The net cash flow from the operating activities in the first quarter was $792 million compared with $72 million in the prior-year quarter.

Total capital expenditures totaled $1,207 million at the end of the first quarter, down from $1,358 million in the year-ago period.

2022 Guidance

The company reaffirmed its 2022 guidance. EIX continues to expect adjusted earnings in the range of $4.40-$4.70 per share. The Zacks Consensus Estimate for earnings is currently pegged at $4.45 per share, lower than the midpoint of the company’s guided range.

Zacks Rank

Edison International currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

FirstEnergy Corporation FE delivered first-quarter 2022 operating earnings per share of 60 cents, which missed the Zacks Consensus Estimate of 62 cents by 3.2%. The bottom line declined by 13% from the year-ago earnings of 69 cents per share.

FirstEnergygenerated operating revenues of $2,991 million in the first quarter, which surpassed the Zacks Consensus Estimate of $2,782 million by 7.5%. FE’s top line improved by 8.7% from $2,752 million in the year-ago quarter.

NextEra Energy NEEreported first-quarter 2022 adjusted earnings of 74 cents per share, which beat the Zacks Consensus Estimate of 69 cents by 7.3%. The bottom line was also up 10.5% from the prior-year quarter.

NextEra Energy’soperating revenues were $2,890 million, which lagged the Zacks Consensus Estimate of $5,178 million by 44.2%. NEE’s top line also decreased by 22.4% year over year.

Entergy Corporation ETR reported first-quarter 2022 adjusted earnings of $1.32 per share, which missed the Zacks Consensus Estimate of $1.38 by 4.3%. The reported figure also declined by 10.2% from $1.47 per share in the year-ago quarter.

Entergy’s first-quarter revenues of $2.88 billion exceeded the Zacks Consensus Estimate of $2.75 billion by 4.8%. As of Mar 31, 2022, ETR had cash and cash equivalents of $701.6 million compared with $442.6 million as of Dec 31, 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance