Easy Come, Easy Go: How Tap Oil (ASX:TAP) Shareholders Got Unlucky And Saw 77% Of Their Cash Evaporate

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example, after five long years the Tap Oil Limited (ASX:TAP) share price is a whole 77% lower. That is extremely sub-optimal, to say the least. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days. Of course, this share price action may well have been influenced by the 24% decline in the broader market, throughout the period.

See our latest analysis for Tap Oil

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Tap Oil moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

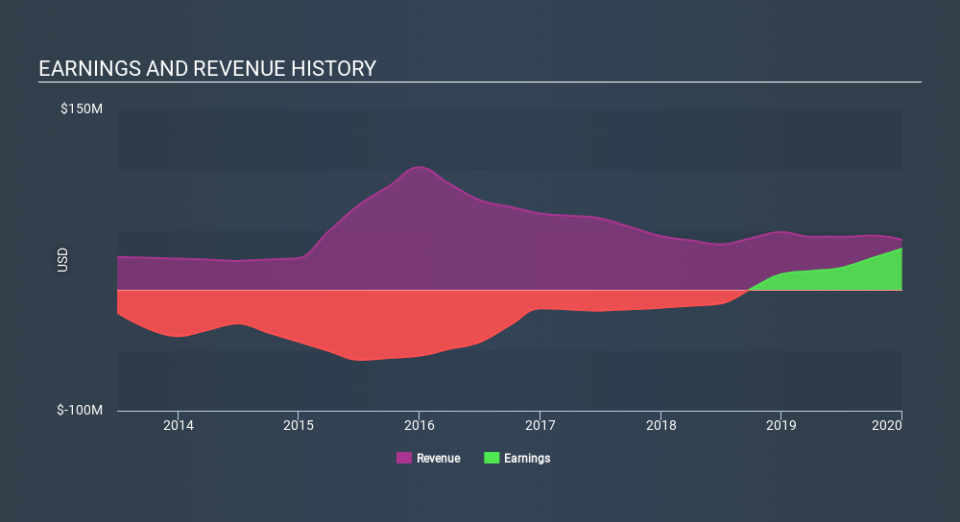

Arguably, the revenue drop of 11% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Tap Oil's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Tap Oil's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Tap Oil's TSR, at -67% is higher than its share price return of -77%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While it's never nice to take a loss, Tap Oil shareholders can take comfort that their trailing twelve month loss of 8.7% wasn't as bad as the market loss of around 13%. What is more upsetting is the 20% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Tap Oil you should be aware of, and 1 of them is significant.

Tap Oil is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance