Earnings Working Against Comfort Systems USA, Inc.'s (NYSE:FIX) Share Price

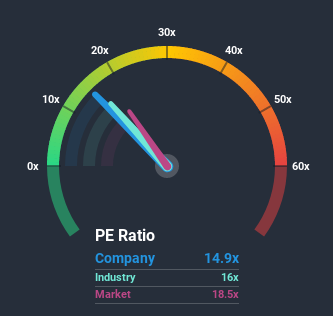

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Comfort Systems USA, Inc. (NYSE:FIX) as an attractive investment with its 14.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Comfort Systems USA certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Comfort Systems USA

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Comfort Systems USA.

Is There Any Growth For Comfort Systems USA?

The only time you'd be truly comfortable seeing a P/E as low as Comfort Systems USA's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 106% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 9.9% during the coming year according to the three analysts following the company. Meanwhile, the broader market is forecast to expand by 0.5%, which paints a poor picture.

In light of this, it's understandable that Comfort Systems USA's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Comfort Systems USA's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Comfort Systems USA maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Comfort Systems USA you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might also be able to find a better stock than Comfort Systems USA. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance