Have Earnings Estimates Come Down Enough?

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

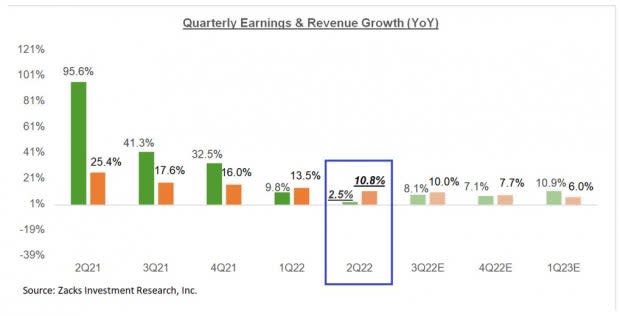

For 2022 Q2, total S&P 500 earnings are expected to increase +2.5% from the same period last year on +10.8% higher revenues and net margin compression of 103 basis points.

Excluding the hefty contribution from the Energy sector, total Q2 earnings for the rest of the S&P 500 index are expected to be down -4.8% on +8.6% higher revenues.

Q2 Earnings estimates for the index as a whole are only modestly down since the start of the quarter, but they are down significantly on an ex-Energy basis.

Part of the uncertainty in the market at present is related to how earnings estimates should evolve in an aggressive Fed tightening cycle. The market has a sense of what should happen to earnings estimates, but it isn’t seeing much of that just yet.

The natural order of things is that rising interest rates take the edge off of aggregate demand, causing the economy to start cooling off. Businesses start experiencing this changed ground reality in their normal operations, which shows up in their quarterly numbers and management’s guidance.

We have started seeing some of that already. For example, recent quarterly results and guidance from the likes of Nike NKE, Bed Bath & Beyond BBBY, and Lennar LEN could be indicative of many more such reports as the June-quarter reporting cycle really gets going in a couple of weeks. That said, not every early reporting company is missing estimates or guiding lower, as we saw in the results from Oracle ORCL, FedEx FDX and General Mills GIS.

To get a sense of the revisions trend, it is instructive to look past the index level aggregate picture and drill a little deeper. The reason we need to do that is the unprecedented positive revisions to the Energy sector as a result of spiking oil and other energy commodity prices. The resulting Energy sector gains have been camouflaging weakening earnings trends in other sectors.

This becomes clear if we look at how full-year 2022 earnings estimates for the S&P 500 index have evolved since the start of the year. The chart below shows how we reached the current aggregate earnings total of $2,005.2 billion for the index since January 1st.

Image Source: Zacks Investment Research

The only way the above positive revisions trend makes sense is if we zero in on the revisions trend for the Energy sector, which you can see in the chart below.

Image Source: Zacks Investment Research

The chart below shows us the aggregate revisions trend for the S&P 500 index on an ex-Energy basis.

Image Source: Zacks Investment Research

The reality is that 2022 earnings estimates for half of the 16 Zacks sectors have come down since the start of the year, with the biggest declines for the Consumer Discretionary, Retail and Aerospace sectors.

Aggregate Energy sector earnings estimates for the year have increased by +73.4% since the start of the year. Other sectors enjoying significant positive revisions since the start of the year include Basic Materials, Autos, Consumer Staples and Construction.

In the aggregate, S&P 500 earnings estimates for the year outside of the Energy sector have been cut -9.8% since the start of the year.

It is reasonable to expect estimates to come down further as the economy slows down in response to aggressive tightening. But it is inaccurate to claim that estimates have not come down. They have, as we show above.

The Overall Earnings Picture

Beyond Q2, the growth picture is expected to modestly improve, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

As strong as the full-year 2022 earnings growth picture is expected to be, it’s worth remembering that a big part of it is due to the unprecedented Energy sector momentum. Excluding the Energy sector, full-year 2022 earnings growth for the remainder of the index drops to only +3.8%.

There is a rising degree of uncertainty about the outlook, reflecting a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening. The evolving earnings revisions trend will reflect this macro backdrop.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance