E&P Financial Group (ASX:EP1) adds AU$18m to market cap in the past 7 days, though investors from five years ago are still down 61%

It's nice to see the E&P Financial Group Limited (ASX:EP1) share price up 17% in a week. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 68% during that time. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

While the last five years has been tough for E&P Financial Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for E&P Financial Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, E&P Financial Group moved from a loss to profitability. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

Arguably, the revenue drop of 9.9% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

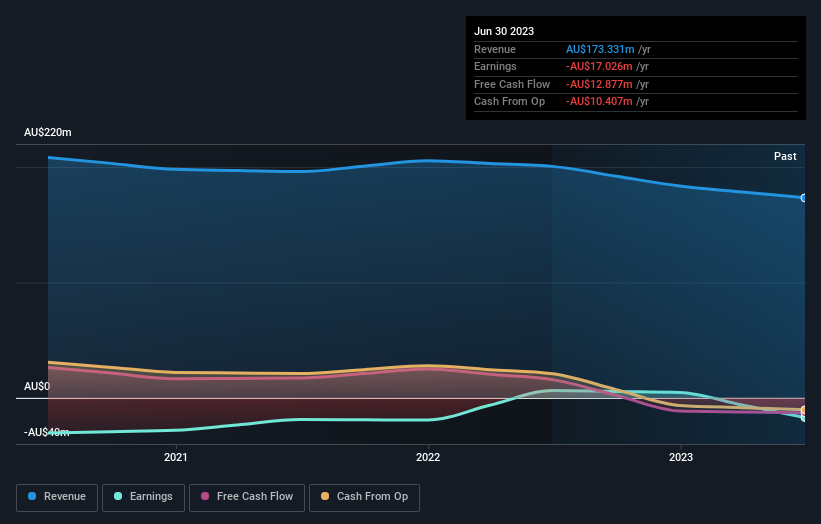

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between E&P Financial Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that E&P Financial Group's TSR, which was a 61% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that E&P Financial Group has rewarded shareholders with a total shareholder return of 16% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand E&P Financial Group better, we need to consider many other factors. For instance, we've identified 2 warning signs for E&P Financial Group (1 can't be ignored) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance