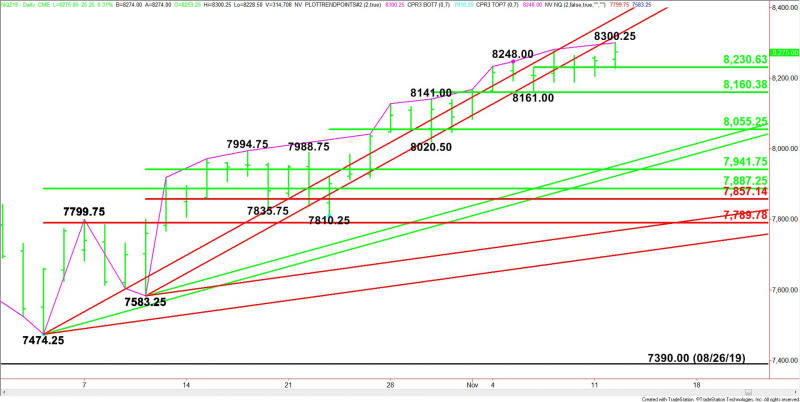

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Minor Pivot at 8230.50 Controlling Near-Term Direction

December E-mini NASDAQ-100 Index futures are trading higher shortly before the close on Tuesday, Earlier in the session the market posted another record high. Shortly after the mid-session, the index dipped from its high following a plunge in shares of Apple, which turned the communications giant lower for the session.

At 21:25 GMT, December E-mini NASDAQ-100 Index futures are trading 8275.00, up 25.25 or +0.31%.

Daily Technical Analysis

The main trend is up according to the daily swing chart. The uptrend was reaffirmed earlier today when buyers took out last week’s high at 8282.25.

The main trend will change to down on a trade through 7583.25. This is highly unlikely, but due to the prolonged move up in terms of price and time, the index is inside the window of time for a potentially bearish closing price reversal top.

The minor trend is also up. A trade through 8161.00 will change the minor trend to down. This will also shift momentum to the downside.

The first minor range is 8161.00 to 8300.25. Its 50% level or pivot is 8230.50. This level provided support earlier in the session.

The second minor range is 8020.50 to 8300.25. Its pivot support is 8160.25.

Daily Technical Forecast

Based on Tuesday’s price action and the current price at 8275.00, the direction into the close is likely to be determined by trader reaction to Monday’s close at 8249.75.

Bullish Scenario

A sustained move over 8249.75 will indicate the presence of buyers. If this generates enough late session momentum, buyers may make a run at the intraday high at 8300.25.

Taking out 8300.25 will indicate the buying is getting stronger. This could lead to a test of an uptrending Gann angle at 8319.25. Crossing to the strong side of this angle will put the index in a bullish position.

Bearish Scenario

A sustained move under 8249.75 will put the index in a position to post a closing price reversal top. This could trigger a break into the first pivot at 8230.50. This is a potential trigger point for an acceleration into the minor bottom at 8161.00, followed closely by another pivot at 8160.25.

This article was originally posted on FX Empire

More From FXEMPIRE:

AUD/USD Forex Technical Analysis – Close Over .6841 Forms Closing Price Reversal Bottom

European Equities: FED Chair Powell, Geopolitics and Stats in Focus

GBP/JPY Price Forecast – British Pound Continues To Consolidate

UK and U.S Inflation and FED Chair Powell Put the GBP and USD in Focus

S&P 500 Price Forecast – Stock Markets Continue To Roar Higher

Yahoo Finance

Yahoo Finance