E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Must Hold Pivot at 8230.50 to Sustain Upside Momentum

December E-mini NASDAQ-100 Index futures are trading slightly lower late Wednesday, bucking the bullish tone set by the benchmark S&P 500 Index and the blue chip Dow Jones Industrial Average. Traders are saying the technology sector is being pressured by the lack of clarity on U.S.-China trade relations from President Donald Trump and escalating tensions in Hong Kong dampened risk appetite.

At 20:16 GMT, December E-mini NASDAQ-100 Index futures are at 8270.00, down 6.50 or -0.07%.

Chipmakers, which get a sizeable chunk of sales from China, were pressured from the start of the cash trade after trading lower during the pre-market session. Nvidia Corp., Micron Technology Inc., Intel Corp. and Advanced Micro Devices Inc. shed between 0.3% and 0.8%.

Daily Technical Analysis

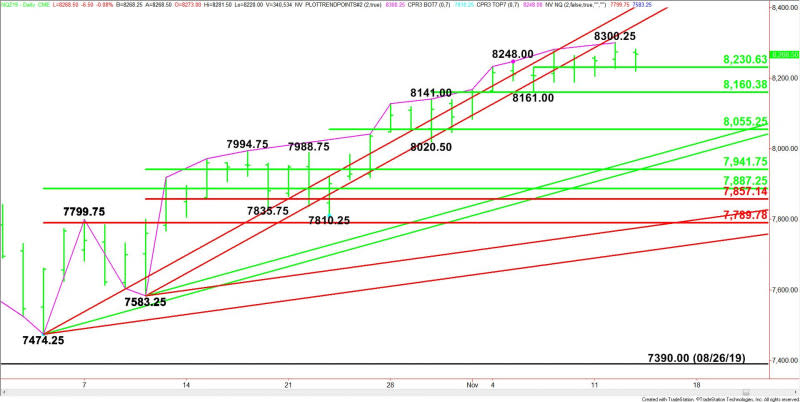

The main trend is up according to the daily swing chart. A trade through 8300.25 will signal a resumption of the uptrend. The main trend will change to down on a trade through 7583.25. This is highly unlikely, however, it is still vulnerable to the downside if minor levels fail as support.

The minor trend is also up. A trade through 8161.00 will change the minor trend to down. This will also shift momentum to the downside.

The first minor range is 8161.00 to 8300.25. Its 50% level or pivot at 8230.50 is acting like support.

The second minor range is 8020.50 to 8300.25. Its 50% level or pivot comes in at 8160.25. This is another potential support level.

Daily Technical Forecast

Based on the early price action, the direction of the December E-mini NASDAQ-100 Index into the close on Wednesday is likely to be determined by trader reaction to the first pivot at 8230.50.

Bullish Scenario

A sustained move over 8230.50 will indicate the presence of buyers. If this move creates enough upside momentum then look for a possible surge into the contract high at 8300.25.

Taking out 8300.25 will signal a resumption of the uptrend with the next target the uptrending Gann angle at 8351.25.

Bearish Scenario

A sustained move under 8230.50 will signal the presence of sellers. This could trigger an acceleration to the downside with the next targets the minor bottom at 8161.00 and the second pivot at 8160.25.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance