E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – April 8, 2019 Forecast

June E-mini NASDAQ-100 Index futures are expected to open lower based on the pre-market trade. The early higher-high, lower-low has also put the index in a position to post a potentially bearish closing price reversal top. The catalyst behind the selling pressure is concern over earnings season which begins on Friday. According to reports, the first quarter earnings season is expected to be the worst in three years.

At 12:46 GMT, June E-mini NASDAQ-100 Index futures are trading 7591.50, down 12.25 or -0.16%.

Daily Technical Analysis

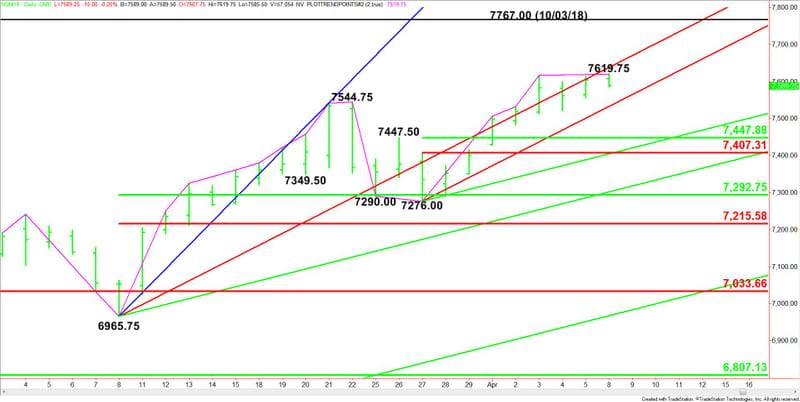

The main trend is up according to the daily swing chart. The uptrend was reaffirmed earlier in the session. A trade through 7276.00 will change the main trend to down. However, a change in trend is not the concern today. What traders should be worried about is a potentially bearish closing price reversal top.

A close under 7604.25 will form a closing price reversal top. If confirmed on Tuesday, this could trigger the start of a 2 to 3 day correction.

The short-term range is 7276.00 to 7619.75. If there is a 2 to 3 day correction then its retracement zone at 7447.75 to 7407.25 will become the primary downside target.

Daily Technical Forecast

Based on the early price action, the direction of the June E-mini NASDAQ-100 Index the rest of the session is likely to be determined by trader reaction to Friday’s close at 7604.25.

Bullish Scenario

A sustained move over 7604.25 will indicate the presence of buyers. Taking out today’s intraday high at 7619.75 will indicate the buying is getting stronger. Overtaking the uptrending Gann angle at 7637.75 will put the index in a bullish position.

Bearish Scenario

A sustained move under 7604.25 will signal the presence of sellers. If this move generates enough downside momentum then look for the selling to possibly extend into the uptrending Gann angle at 7532.00.

Look for buyers on the first test of 7532.00. If this uptrending Gann angle fails then look for an acceleration to the downside with the next target the short-term 50% level at 7447.75.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – April 8, 2019 Forecast

EUR/USD Price Forecast – Euro breaks out of short term consolidation

Earnings Season Begins, Equities Markets Mixed, Trade Hopes Take Back Seat

Gold Price Forecast – Gold markets break crucial $1300 level

AUD/CHF Bullish Head and Shoulders Might Lead the Pair to W H4 Resistance

Yahoo Finance

Yahoo Finance