E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Needs to Hold 9599.25 to Sustain Upside Momentum

March E-mini NASDAQ-100 Index futures are called higher based on the premarket trade. The market is following the lead set by shares in Asia and Europe amid easing tensions over the spread of coronavirus.

A slight slowing of the rate of new cases has lifted investor sentiment. However, traders continue to monitor China’s attempts to return factories to production after Apple warned on Monday of lower revenue expectations due to disruptions in the supply chain.

At 12:11 GMT, March E-mini NASDAQ-100 Index futures are trading 9672.00, up 36.00 or 0.37%.

Daily Technical Analysis

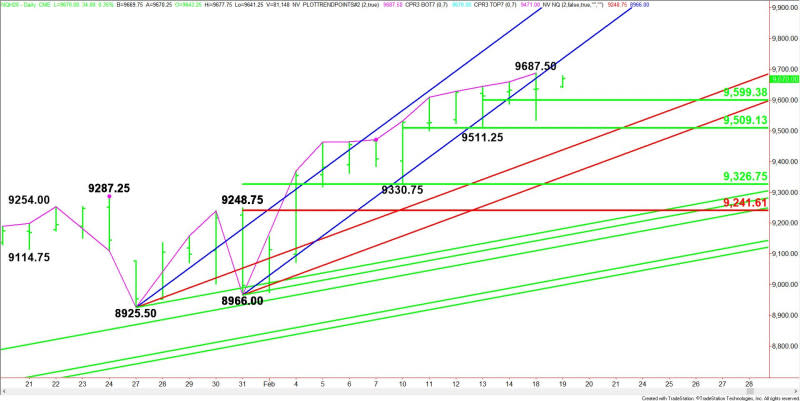

The main trend is up according to the daily swing chart. A trade through 9687.50 will signal a resumption of the uptrend. The main trend will change to down on a more through 8966.00. This is highly unlikely, but the index is inside the window of time for a potentially bearish closing price reversal top. This won’t change the trend to down, but it could trigger a near-term correction.

The minor trend is also up. A trade through 9511.25 will change the minor trend to down. This will also shift momentum to the downside.

A trade through 9687.50 will turn 9534.25 into a new main bottom and a new trigger point for a shift in momentum to down.

The first minor range is 9511.25 to 9687.50. Its 50% level or pivot is 9599.25. The second minor range is 9330.75 to 9687.50. Its 50% level or pivot comes in at 9509.00. Since the main trend is up, buyers could come in on a test of these levels.

The main range is 8966.00 to 9687.50. Its retracement zone at 9326.75 to 9241.50 is key support and a value area.

Daily Technical Forecast

Holding above the first pivot at 9599.25 on Wednesday will give the March E-mini NASDAQ-100 index an upside bias. If the upside momentum increases throughout the session then look for the rally to extend into 9687.50. Overtaking the steep uptrending Gann angle at 9734.00 will put the index in a bullish position.

On the downside, the first target is the pivot at 9599.25. If this price fails as support then look for a potential acceleration to the downside with the first targets the minor bottom at 9511.25 and the minor 50% level at 9509.00.

Taking out 9509.00 will indicate the selling pressure is getting stronger. This could lead to a test of the first uptrending Gann angle at 9437.50.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance