E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – January 11, 2019 Forecast

March E-mini Dow Jones Industrial Average futures are trading lower at the midsession. The market is also inside yesterday’s range which suggests investor indecision and impending volatility. Investors are trimming positions ahead of the week-end on concerns over the U.S. government shutdown and worries over a possible slowdown in the Chinese economy.

At 1648 GMT, March E-mini Dow Jones Industrial Average futures are trading 23905, down 48 or -0.20%.

Daily Technical Analysis

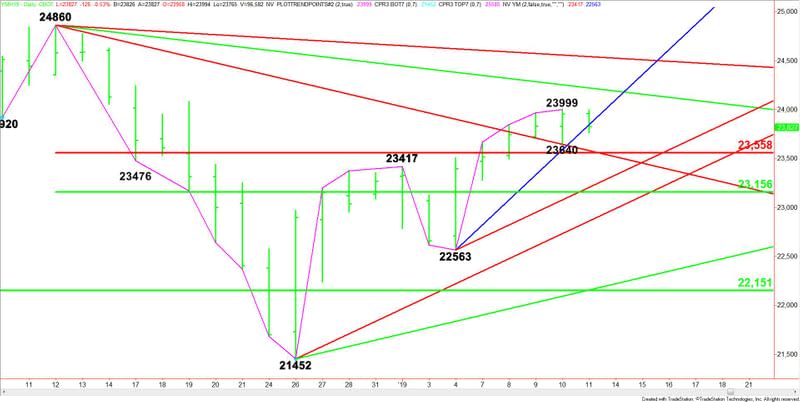

The main trend is up according to the daily swing chart. A trade through 23999 will signal a resumption of the uptrend. The next major target is the 24860 main top. A trade through 22563 will change the main trend to down.

The minor trend is also up. A trade through 23640 will change the minor trend to down. This will also shift momentum to the downside.

The main range is 24860 to 21452. Its retracement zone at 23558 to 23156 is the first downside target and support area. This zone is controlling the near-term direction of the market.

Daily Technical Forecast

Based on the earlier price action and the current price at 23905. The direction of the March E-mini Dow Jones Industrial Average futures contract into the close on Friday is likely to be determined by trader reaction to the short-term uptrending Gann angle at 23843.

Bullish Scenario

Overtaking and sustaining a rally over 23843 will indicate the return of buyers. The first target is the minor top at 23999. This is followed by a downtrending Gann angle at 24220.

The angle at 24220 is the trigger point for an acceleration to the upside with the next target angle coming in at 24540. This is the last potential resistance angle before the 24860 main top.

Bearish Scenario

A sustained move under 24843 will signal the presence of sellers. If this move creates enough downside momentum then look for a break into the minor bottom at 23640. Taking out this level will change the minor trend to down. This could trigger a further break into a support cluster formed by a downtrending Gann angle at 23580 and the main Fibonacci level at 23558.

We could see a technical bounce on the first test the support cluster, but if 23558 fails then look an acceleration to the downside with the next targets a short-term uptrending Gann angle at 23203 and the main 50% level at 23156.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance