E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – 23571 – 23796 to Major Area to Overcome

June E-mini Dow Jones Industrial Average futures continue to climb on Wednesday and are currently sitting near its intraday high at the mid-session. The catalysts behind the rally are hopes the coronavirus outbreak in the United States was close to its peak and expectations that Congress will inject hundreds of billions more in the battered economy.

At 16:42 GMT, June E-mini Dow Jones Industrial Average futures are trading 23123, up 632 or +2.81%.

After an early surge, the intraday volatility has slowed ahead of the release of the minutes from the last Federal Reserve emergency meeting. Investors hope the Fed will shed some light on whether it is prepared to stimulate the economy further.

Daily Technical Analysis

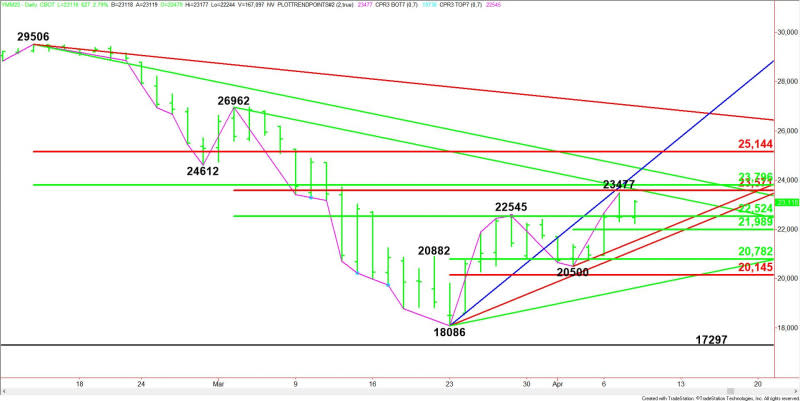

The main trend is up according to the daily swing chart. A trade through 23477 will signal a resumption of the uptrend. The main trend will change to down if sellers take out the last main bottom at 20500.

The main range is 29506 to 18086. Its retracement zone at 23796 to 25144 is the primary upside target. This zone is controlling the longer-term direction of the Dow.

The intermediate range is 26962 to 18086. The Dow is currently testing its retracement zone at 22524 to 23571.

The two zones combine to form a resistance cluster at 23571 to 23796.

The minor range is 20500 to 23477. Its 50% level or pivot at 21989 is a potential downside target.

The short-term range is 18086 to 23477. Its retracement zone at 20782 to 20145 is the most important downside target.

Daily Technical Forecast

Based on the early price action and the current price at 23123, the direction of the June E-mini Dow Jones Industrial Average into the close is likely to be determined by trader reaction to the 50% level at 22524.

Bullish Scenario

A sustained move over 22524 will indicate the presence of buyers. This could trigger a rally into a cluster of potential resistance levels including 23477, 23571, 23634 and 23796. Overtaking 23796 could trigger a surge into 24230 and 24514.

The daily chart starts to open up over 24514.

Bearish Scenario

A sustained move under 22524 will signal the presence of sellers. This is followed by a 50% level at 21989 and a pair of uptrending Gann angles at 21524 and 21158.

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/USD Price Forecast – British Pound Continues to Stubbornly Rally

Gold Price Prediction – Prices Consolidate Following Fed Meeting Minutes

Mid-Week Drivers: COVID-19, Oil Prices and Russia and Boris Johnson

Natural Gas Price Fundamental Daily Forecast – Supported by Cold Temperatures, Noted Production Cuts

Natural Gas Price Prediction – Prices Slump Ahead of Inventories Release

Yahoo Finance

Yahoo Finance