E-mini Dow Jones Industrial Average (YM) Futures Analysis – September 24, 2018 Forecast

December E-mini Dow Jones Industrial Average futures are trading steady to lower shortly after the cash market opening. Investors are adjusting positions following the news that China cancelled its mid-level trade meeting with the United States and ahead of the Fed’s widely expected interest rate hike on Wednesday and monetary policy statement.

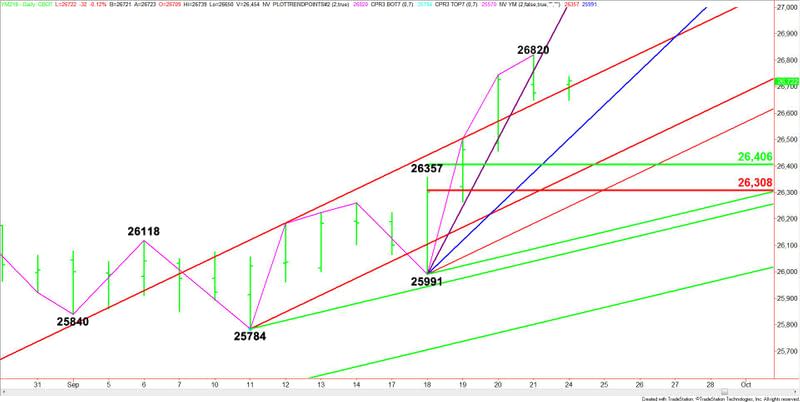

Daily Technical Analysis

The main trend is up according to the daily swing chart. However, momentum may be trying to shift to the downside with the formation of the closing price reversal top on Friday.

A trade through 26820 will negate the closing price reversal top and signal a resumption of the uptrend. Taking out 26650 will confirm the closing price reversal top. This could trigger the start of a 2 to 3 day correction, and/or 50% to 61.8% correction of the last range. The main trend changes to down on a trade through 25991.

The short-term range is 25991 to 26820. Its retracement zone at 26406 to 26308 is the primary downside target. Since the main trend is up, buyers could come in on the first test of this zone.

Daily Technical Forecast

Based on the early price action, the direction of the December E-mini Dow Jones Industrial Average on Monday is likely to be determined by trader reaction to the long-term uptrending Gann angle at 26698.

A sustained move over 26698 will indicate the presence of buyers. If this creates enough upside momentum then look for a possible retest of 26820.

Taking out 26820 will indicate the buying is getting stronger. The next upside target is a steep uptrending Gann angle at 27015. Crossing to the strong side of this angle will put the Dow in an extremely strong position.

A sustained move under 26698 will signal the presence of sellers. Look for an acceleration to the downside if 26650 fails as support. This could trigger a break into the steep uptrending Gann angle at 26503.

If 26503 fails as support then look for the selling pressure to possibly extend into a price cluster at 26406, 26360 and 26308. A test of this area could bring in new buyers.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance