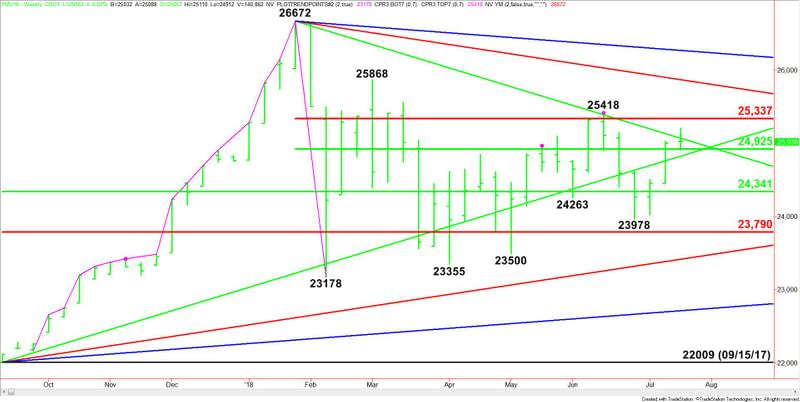

E-mini Dow Jones Industrial Average (YM) Futures Analysis – Failure to Hold 24889 Could Trigger Steep Break

E-mini Dow futures settled slightly higher last week, bucking the trend of the other two major indexes. However, it also gave back most of its gains from early in the week. Volume was low and the range was tight. Earnings and revenue reports were supportive, but comments from President Trump threatening additional tariffs on China, weighed on prices late in the week.

Last week, September E-mini Dow Jones Industrial Average futures settled at 25030, up 26 or +0.10%.

Weekly Technical Analysis

The main trend is up according to the weekly swing chart. However, the price action can best be described as sideways since early February.

The minor trend is down. A trade through 25418 will change the minor trend to up and shift momentum to the upside. A trade through 23978 will reaffirm the minor trend.

The main range is 22009 to 26672. Its retracement zone is 24341 to 23790. This zone should be considered support. Trading above this zone is helping to generate an upside bias.

The short-term range is 26672 to 23178. The Dow is currently trading inside its retracement zone at 24925 to 25337. Trader reaction to this zone will determine the near-term direction of the market.

Daily Technical Forecast

Based on last week’s price action and the close at 25030, the direction of the September E-mini Dow Jones Industrial Average futures contract this week will be determined by trader reaction to the downtrending Gann angle at 25008.

A sustained move over 25008 will indicate the presence of buyers. This could create the upside momentum needed to challenge the Fib level at 25337, followed closely by the minor top at 25418.

Taking out 25418 could trigger an acceleration to the upside with the next target angle coming in at 25840.

A sustained move under 25008 will signal the presence of sellers. This could trigger a fast break into the 50% level at 24925, followed closely by an uptrending Gann angle at 24889.

Watch the price action and read the order flow at 24889 very closing. Taking out this level could trigger a steep sell-off with 24341 the next major downside target.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance