Duke Energy's (DUK) Pisgah Ridge Solar Project Comes Online

Duke Energy Corp.’s DUK arm, Duke Energy Sustainable Solutions, recently announced the commencement of the operations of its Pisgah Ridge Solar project in Navarro County, TX. This solar power plant, which boasts a capacity of 250 megawatts (MW), is claimed to be the largest solar project of Duke Energy.

The company has inked a supply deal with Charles River Laboratories International for providing 102 MW power for the Pisgah project over the next 15 years. This bolsters the inflow of revenues for DUK from the project in the long term.

Duke Energy’s Growth Prospects in Texas

Duke Energy’s commitment to making its operations eco-friendly to provide more sustainable and reliable energy to customers can be gauged by its efforts to continue to invest in new generating capacity. The recent project addition in Texas is part of its pledge to achieve a net-zero target in carbon emissions by 2050.

DUK can solidify its footprint in Texas’ solar projects with the State offering immense growth potential. Texas ranked second in 2022 in the United States in terms of the total installed solar capacity. Per the latest report from the Solar Energy Industries Association, the region has installed 17,247 MW of solar capacity to date, out of which 3,399 MW were installed in 2022.

Going forward, Texas boasts a capacity addition of 34,324 MW in the next five years. This exhibits immense opportunities for utilities to develop large-scale utility solar projects in the region and expand in the small-scale solar project arena.

In light of the aforementioned factors, Duke Energy’s energy transition strategy in Texas is likely to deliver profitable returns and provide an edge to the company with an already established position. The latest addition of the solar project opens avenues for the company to expand its footprint in Texas.

Utilities’ Focus on the Texas Region

Considering the strong solar growth prospects of the Texas region, utilities are steadily expanding their footprint in the region. Apart from Duke Energy, utilities that have strengthened their position in the Texas solar space are as follows:

In January 2023, WEC Energy Group WEC announced that it acquired an 80% ownership interest in the Samson I Solar Energy Center. Samson I is a 250 MW project located in Texas.

WEC Energy’s long-term earnings growth rate is 5.8%. Shares of WEC Energy have delivered 4.2% to its investors in the past six months.

In February 2023, Entergy Corporation’s ETR arm, Entergy Texas, entered into a long-term power purchase agreement in Texas for the purchase of Umbriel’s solar project total output, which is enough energy to power more than 30,000 homes.

The long-term earnings growth rate of Entergy is 6%. ETR shares have increased 4.4% in the past six months.

NextEra Energy’s NEE Waco Solar Project is an innovative solar project proposed for Limestone County, TX, which will have a capacity of up to 400 MW of clean, renewable energy. The project is scheduled to begin operations as early as December 2023.

NextEra boasts a long-term earnings growth rate of 9%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 27.1% from the prior-year reported figure.

Price Movement

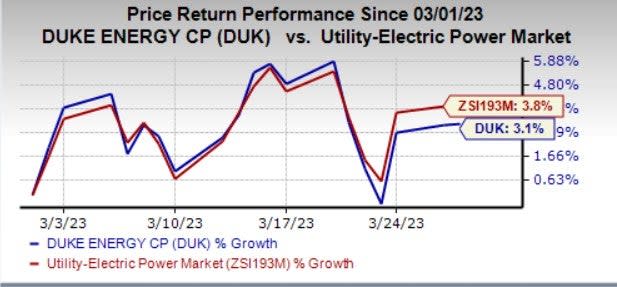

In the past month, Duke Energy’s shares have increased 3.1% compared with the industry’s growth of 3.8%.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance