Duke Energy (DUK) Q2 Earnings Top Estimates, Revenues Rise Y/Y

Duke Energy Corporation DUK reported second-quarter 2022 adjusted earnings of $1.14 per share, which beat the Zacks Consensus Estimate of $1.10 by 3.6%. The bottom line however dropped 0.9% year over year.

This year-over-year decline is attributable to higher operation and maintenance expense due to plant outage timing in the Electric Utilities and Infrastructure segment along with higher interest expense and the impact of GIC minority interest.

Including one-time adjustments also, the company reported GAAP earnings of $1.14 per share compared with the year-ago quarter’s earnings of 96 cents.

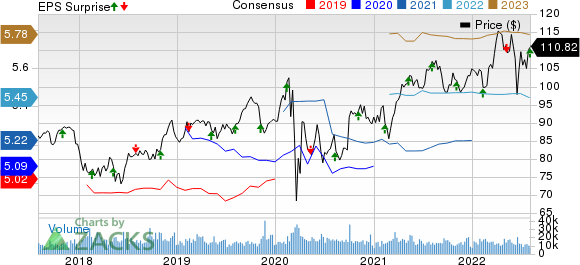

Duke Energy Corporation Price, Consensus and EPS Surprise

Duke Energy Corporation price-consensus-eps-surprise-chart | Duke Energy Corporation Quote

Total Revenues

Total operating revenues came in at $6,685 million, which improved 16.1% from $5,758 million a year ago. The reported top-line figure also surpassed the Zacks Consensus Estimate of $6,022.6 million by 11%.

The Regulated electric unit’s revenues were $6,074 million (up 15.5% year over year), representing 90.9% of total revenues for the quarter.

Revenues from the regulated natural gas business totaled $425 million, up 40.7% year over year.

The Non-regulated Electric and Other segment generated revenues of $186 million, which dropped 6.1% year over year.

Highlights of the Release

Duke Energy’s total operating expenses amounted to $5,280 million in the reported quarter, up 15% year over year. The increase was driven by higher cost of fuel used in electric generation and purchased power, cost of natural gas, depreciation and amortization expenses as well as the cost of property and other taxes. Also, higher operation maintenance and other expenses resulted in an increase in operating expenses.

Operating income improved 20.9% to $1,413 million from $1,169 million in the year-ago quarter.

Interest expenses rose to $607 million from $572 million in second-quarter 2021.

For the reported quarter, the average number of customers in its electric utilities increased 1.8% year over year. Total electric sales volumes for the reported quarter went up 6.7% year over year to 64,485 gigawatt-hours.

Segmental Highlights

Electric Utilities & Infrastructure: This segment’s adjusted earnings for the second quarter totaled $958 million, up from $935 million in the second quarter of 2021.

Gas Utilities & Infrastructure: Earnings generated from this segment totaled $19 million compared with $17 million in the year-ago period.

Commercial Renewables: This segment reported earnings of $30 million for the quarter under review compared with $47 million in the year-ago period.

Other: The segment includes corporate interest expenses not allocated to other business units, resulting from Duke Energy’s captive insurance company and other investments.

This segment incurred a loss of $130 million compared with a loss of $248 million in the year-ago quarter.

Financial Condition

As of Jun 30, 2022, Duke Energy had cash & cash equivalents of $428 million, up from $343 million on Dec 31, 2021.

As of Jun 30, 2022, long-term debt was $63.15 billion compared with $60.45 billion on Dec 31, 2021.

During the first six months of 2022, the company generated net cash from operating activities of $4.04 billion compared with $3.87 billion generated in the first six months of 2021.

Guidance

Duke Energy has reaffirmed its 2022 adjusted EPS guidance. The company still expects to generate adjusted earnings per share in the range of $5.30-$5.60.

The Zacks Consensus Estimate for 2022 earnings, pegged at $5.45 per share, lies in line with the midpoint of the company’s projected range.

The company also continues to expect its long-term earnings per share growth in the range of 5-7% through 2026.

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc. NEE reported second-quarter 2022 adjusted earnings of 81 cents per share, which beat the Zacks Consensus Estimate of 75 cents by 8%. The bottom line was also up 14.1% from the prior-year quarter.

For the second quarter, NextEra’s operating revenues were $5,183 million, which lagged the Zacks Consensus Estimate of $5,681 million by 8.8%. However, NEE’s top line improved 31.9% year over year.

American Electric Power Company, Inc. AEP reported second-quarter 2022 operating EPS of $1.20, which beat the Zacks Consensus Estimate of $1.18 by 1.7%. The bottom line also improved 1.7% from $1.18 per share in the year-ago quarter.

American Electric’s second-quarter revenues of $4,593.8 million beat the Zacks Consensus Estimate of $4,191.2 million by 9.6%. AEP expects 2022 operating earnings in the range of $4.87-$5.07 per share.

CMS Energy Corporation CMS reported second-quarter 2022 adjusted EPS of 53 cents, which beat the Zacks Consensus Estimate of 44 cents by 20.5%. However, the reported figure declined 3.6% on a year-over-year basis.

CMS Energy had cash and cash equivalents of $77 million as of Jun 30, 2022, down from $452 million at the end of 2021. CMS expects 2022 adjusted earnings in the range of $2.85-$2.89 per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance