Duckhorn (NYSE:NAPA) Reports Q1 In Line With Expectations But Stock Drops

Wine company The Duckhorn Portfolio (NYSE:NAPA) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.4% year on year to $92.53 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $403 million at the midpoint. It made a non-GAAP profit of $0.14 per share, down from its profit of $0.16 per share in the same quarter last year.

Is now the time to buy Duckhorn? Find out in our full research report.

Duckhorn (NAPA) Q1 CY2024 Highlights:

Revenue: $92.53 million vs analyst estimates of $92.15 million (small beat)

EPS (non-GAAP): $0.14 vs analyst expectations of $0.15 (7.4% miss)

The company reconfirmed its revenue guidance for the full year of $403 million at the midpoint

Gross Margin (GAAP): 55.6%, in line with the same quarter last year

Free Cash Flow of $21.12 million is up from -$50.66 million in the previous quarter

Sales Volumes fell 4.6% year on year

Market Capitalization: $1.14 billion

“Our teams continued to execute against a challenging industry backdrop,” said Deirdre Mahlan, President, CEO and Chairperson.

With many of their grapes sourced from the famous Napa Valley region of California, The Duckhorn Portfolio (NYSE:NAPA) is a producer of premium wines and known for its Merlot and other Bordeaux varietals.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Duckhorn is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

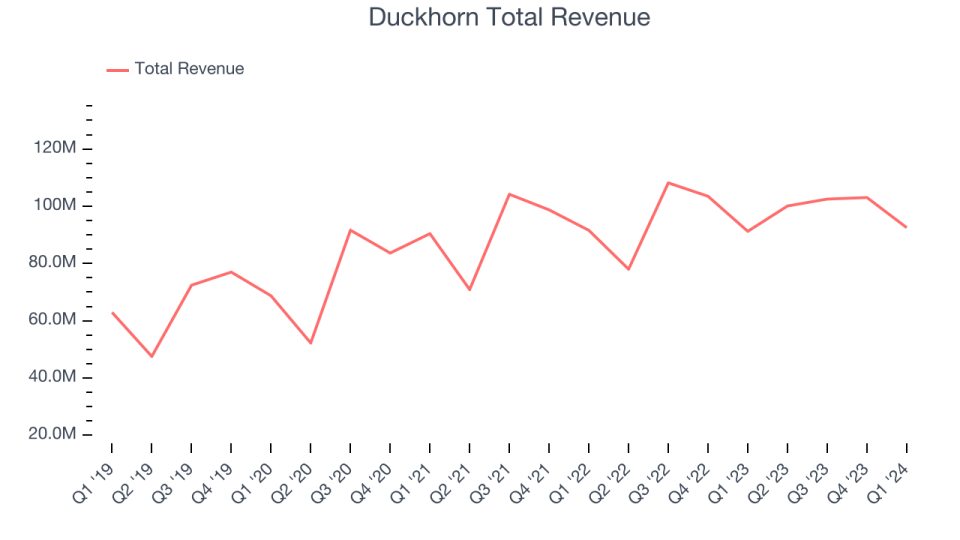

As you can see below, the company's annualized revenue growth rate of 7.8% over the last three years was decent for a consumer staples business.

This quarter, Duckhorn grew its revenue by 1.4% year on year, and its $92.53 million in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 21.7% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

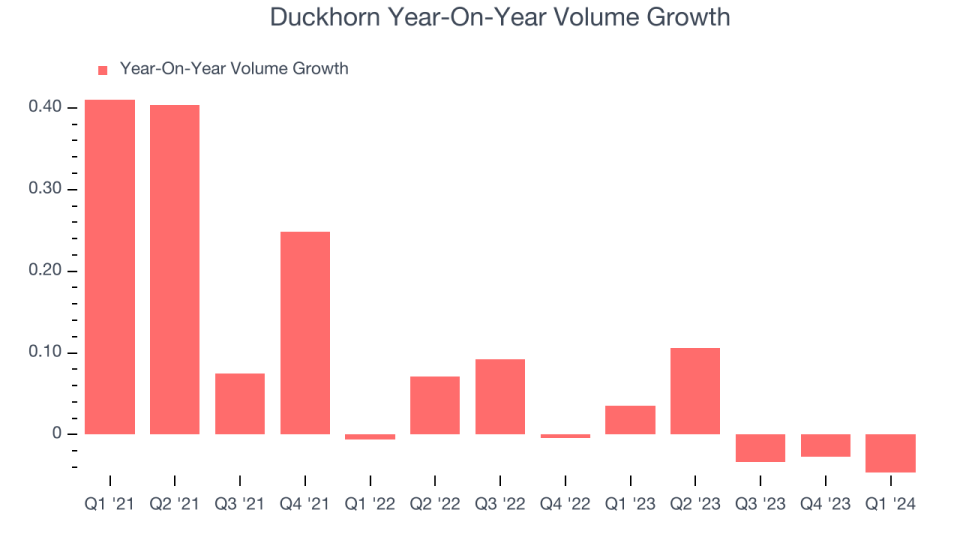

Duckhorn's average quarterly volume growth was a healthy 2.4% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Duckhorn's Q1 2024, sales volumes dropped 4.6% year on year. This result was a reversal from the 3.5% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn't deter you from investing in a business. We'll be monitoring the company to see how things progress.

Key Takeaways from Duckhorn's Q1 Results

It was encouraging to see Duckhorn slightly top analysts' gross margin expectations this quarter. On the other hand, its operating margin and EPS missed analysts' expectations. Additionally, its full-year EPS guidance fell short. Overall, this was a bad quarter for Duckhorn. The company is down 6.1% on the results and currently trades at $7.31 per share.

Duckhorn may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance