Dow (DOW) Poised on Cost Reductions, Project Investments

We issued an updated research report on material science company Dow Inc. DOW on Dec 5.

Dow, in its third-quarter call, said that it will remain focused on investing in higher-return growth projects, achieving its stranded cost removal target and leveraging its feedstock flexibility in the prevailing market environment.

Dow remains committed to invest in attractive areas through highly accretive projects. It is investing in several high-return growth projects including the expansion of downstream silicones capacity. The company has already completed 14 of the 18 downstream capacity expansion projects that it plans to execute this year. During the third quarter, Dow also announced the retrofit of its Louisiana cracker with its proprietary fluidized catalytic dehydrogenation (FCDh) technology to make on-purpose propylene. Dow also landed a deal with the Netherlands-based Fuenix Ecogy Group for the supply of pyrolysis oil feedstock. The agreement is a major step to increase feedstock recycling.

The company should also gain from cost synergy savings and productivity actions. It focuses on maintaining cost and operational discipline through cost synergy as well as stranded cost-removal initiatives. Dow completed its roughly $1.37 billion cost synergy program and removed $40 million of stranded costs in the third quarter. It also expects $65-$75 million in cost removal in the fourth quarter. The company remains on track to deliver around $700 million of synergy and stranded cost savings in 2019.

Moreover, Dow is committed to return value to its shareholders by leveraging healthy cash flows. Dow generated strong operating cash flows from continuing operations of $1.8 billion in the third quarter, up from $203 million in the comparable quarter a year ago. It returned $600 million ($500 million in dividend and $100 million in share buybacks) to its shareholders in the quarter. The company is on track with its goal of $500 million worth share repurchases this year.

However, Dow is exposed to a challenging demand environment in certain markets. Weak demand is hurting its volumes across specific regions. The company is seeing softer demand in agriculture, automotive and electronics end markets. Slowing global economic growth amid trade tensions is hurting demand. Softer demand may continue to put pressure on volumes and the company’s top line.

Dow also faces headwind from spending related to planned turnaround activities. The company expects roughly $20 million headwind in the fourth quarter in its Performance Materials & Coatings unit due to the planned propylene dehydrogenation (PDH) unit turnaround. It also sees a $40 million impact from planned PDH turnaround at the Industrial Intermediates & Infrastructure unit. Moreover, planned turnaround at the cracker in the Netherlands is expected have an unfavorable impact of $15 million in the quarter at the Packaging & Specialty Plastics segment. These turnarounds may weigh on margins in these businesses.

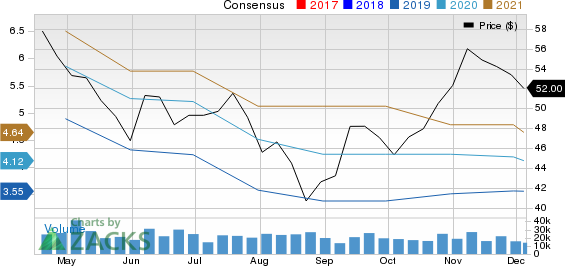

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Price Performance

Dow’s shares are up 17% over the past three months, compared with the 4.7% rise recorded by the industry.

Zacks Rank & Key Picks

Dow currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space include Kirkland Lake Gold Ltd. KL, Agnico Eagle Mines Limited AEM and Franco-Nevada Corporation FNV.

Kirkland Lake Gold has projected earnings growth rate of 97.1% for the current year and sports a Zacks Rank #1 (Strong Buy). The company’s shares have surged around 76% in a year’s time. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle has a projected earnings growth rate of 167.9% for the current year and carries a Zacks Rank #2 (Buy). The company’s shares have rallied roughly 54% in a year’s time.

Franco-Nevada has estimated earnings growth rate of 45.3% for the current year and carries a Zacks Rank #2. The company’s shares have shot up roughly 36% in a year’s time.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dow Inc. (DOW) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance