Don’t Look Now, But GE Is Getting Somewhere

(Bloomberg Opinion) -- General Electric Co.’s path to recovery is a long one, but the company no longer seems lost in the woods.

In releasing its third-quarter results on Wednesday, GE also raised its guidance for 2019 free cash flow and now anticipates its industrial businesses could bring in as much as $2 billion this year. That’s a $4 billion swing from GE’s worst-case scenario in its initial March forecast. There’s a fine line between setting a low bar and sandbagging the numbers, but GE’s rosier outlook is supported by signs of stabilization in its beleaguered power unit and there being less of a drag than anticipated from the transition of a supply-chain financing program to a third party. The aviation business was also able to largely offset the negative impact of the continued grounding of Boeing Co.’s 737 Max. Those were key worry points that ended up not being as worrisome.

It wasn’t a perfect quarter and there are some notable footnotes to that guidance increase. Still, a lack of nasty surprises and minimal signs to date of macroeconomic weakness in GE’s aviation and health-care businesses make this a victory for CEO Larry Culp. A flurry of deleveraging activities in the last two months had raised concerns that GE was trying to give itself some good news to talk about if the actual quarterly numbers were disappointments, particularly amid growing concerns that a manufacturing slowdown was deepening. That fear appears unfounded, at least as far as the last three months are concerned for GE’s businesses.

Shares of GE rallied as much as 14% on the report, essentially erasing a slide since its last earnings update in July that in part reflected concerns over the impact of slumping interest rates. The decline in rates forced GE to reassess its expectations for the returns it will get on assets supporting the company’s long-term-care insurance business. While this contributed to a $1 billion pre-tax charge in the latest quarter as the company bolstered its GAAP reserves, it’s better than the “ somewhere south” of $1.5 billion adjustment – before other offsets – that Culp had flagged in September. And it’s certainly nowhere in the ballpark of what’s implied in the $29 billion reserve shortfall Bernie Madoff whistle-blower Harry Markopolos claimed existed.

Operating profit for the power segment turned negative again after a few quarters of positive numbers. But margins did improve in that business – to negative 3.7% from negative 14.8% a year earlier – which GE says reflects better pricing discipline. The company now expects the cash burn at the power unit to be no worse than the $2.3 billion outflow last year (adjusted for a reorganization of that business), versus an initial prediction of a substantial year-over-year weakening. The health-care division saw a nice lift in profit margins and a 5% jump in sales, even as its imaging business struggled in China and some larger U.S> projects got pushed out. And aviation rebounded from an uncharacteristically weak second quarter. These are all positive data points that speak to Culp’s push for operational improvements.

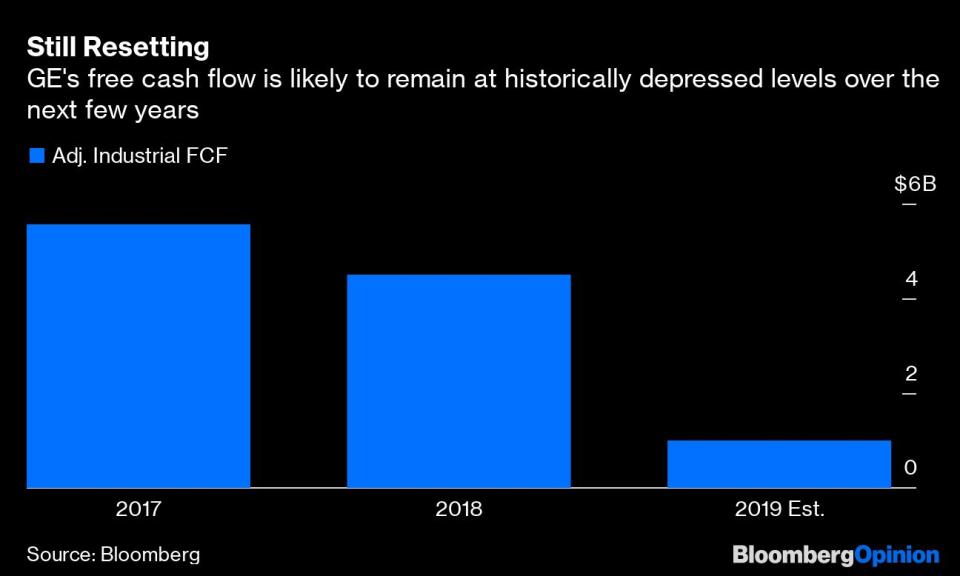

What hasn’t changed is that even at $2 billion, GE’s free cash flow will be very weak this year. The current forecast compares to $4.5 billion last year and $5.6 billion in 2017. While a stronger starting point in 2019 certainly helps, GE will have to overcome a number of challenges to get back to even those depressed levels.

Already, GE will lose about $1 billion in free cash flow in 2020 from the sale of its biopharmaceutical business to Danaher Corp., per analysts’ estimates. Despite an improved performance in 2019, there’s no update at this time for GE’s expectation for the power unit to continue burning cash next year. And GE has to keep spending on restructuring. It again lowered its estimate for the cost of these cutbacks this year (which was a boon to its free-cash-flow outlook) in part because of the “timing” of politically fraught conversations in Europe over facilities and employees absorbed as part of its disastrous acquisition of Alstom SA’s power business. Keeping economic headwinds at bay will also be key.

Meanwhile, GE will get lower contributions from Baker Hughes as it continues to wind down its stake; a divestiture in September pushed that holding below 50%, forcing the company to take an $8.7 billion pre-tax charge in the quarter.

Culp is doing what he needs to do to stop the bleeding at GE. Now the conversation shifts to what kind of company this is going to look like when he’s done and how far this turnaround can go.

To contact the author of this story: Brooke Sutherland at bsutherland7@bloomberg.net

To contact the editor responsible for this story: Beth Williams at bewilliams@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brooke Sutherland is a Bloomberg Opinion columnist covering deals and industrial companies. She previously wrote an M&A column for Bloomberg News.

For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Yahoo Finance

Yahoo Finance