Dollar Steady Against Soft US Consumer Confidence Report

DailyFX.com -

Talking Points:

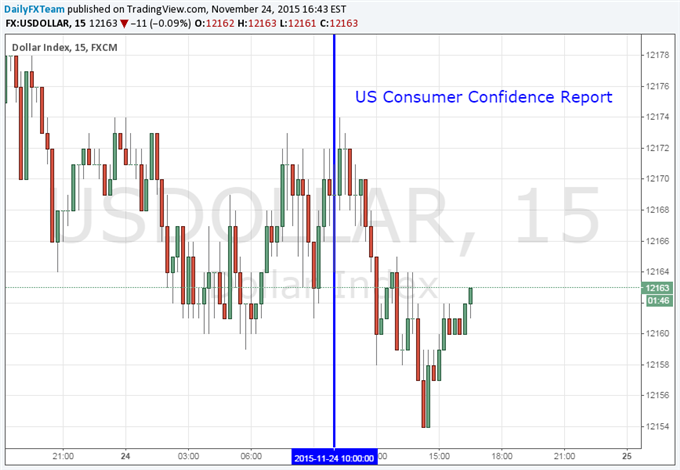

US Dollar offered a tepid response to the soft consumer confidence report

Conference Board’s survey showed the lowest print in over a year with a reading of 90.1

The restrained response likely indicates traders do not expect the data to alter Fed policy vote

Macroeconomic events affect currency valuations. Stay updated with major releases on our calendar.

The greenback offered a lukewarm reaction to the lowest US consumer confidence report since September of 2014. The survey from the Conference Board offered a print of 90.4 in November. This reading was below the markets’ forecast of 99.5 as well as the previous month’s revised 99.1.

The restrained response from the US Dollar may be due to the markets’ expectation that the soft consumer sentiment report will not alter Federal Reserve monetary policy decision next month. The current implied probability of a rate hike at the December 16 meeting is 78 percent according to Fed Fund futures, up from yesterday’s odds of a 74 percent chance.

In reference to rate speculation, however, some of the component data could mar the robust hawkish outlook. The labor conditions data in particular left rate hike acolytes wanting. From the wage forecast statistics, the net percentage of respondents expecting an increase in their earnings over those seeing take home decline slipped to 5.4 percentage points – the thinnest gap in 13 months.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance