What Does good natured Products' (CVE:GDNP) CEO Pay Reveal?

This article will reflect on the compensation paid to Paul Antoniadis who has served as CEO of good natured Products Inc. (CVE:GDNP) since 2015. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for good natured Products.

View our latest analysis for good natured Products

How Does Total Compensation For Paul Antoniadis Compare With Other Companies In The Industry?

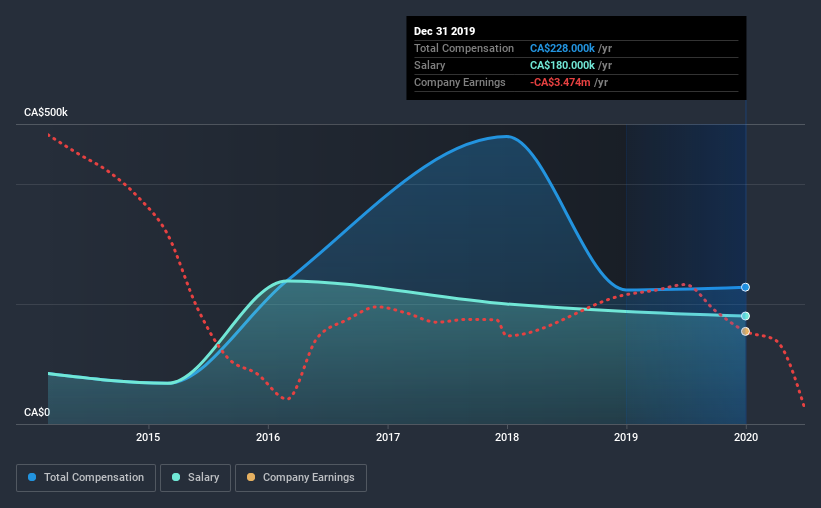

At the time of writing, our data shows that good natured Products Inc. has a market capitalization of CA$49m, and reported total annual CEO compensation of CA$228k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CA$180.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under CA$263m, the reported median total CEO compensation was CA$508k. In other words, good natured Products pays its CEO lower than the industry median. What's more, Paul Antoniadis holds CA$2.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$180k | CA$188k | 79% |

Other | CA$48k | CA$36k | 21% |

Total Compensation | CA$228k | CA$224k | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. good natured Products pays out 79% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

good natured Products Inc.'s Growth

good natured Products Inc. has seen its earnings per share (EPS) increase by 12% a year over the past three years. It achieved revenue growth of 69% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has good natured Products Inc. Been A Good Investment?

Most shareholders would probably be pleased with good natured Products Inc. for providing a total return of 306% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, good natured Products Inc. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Considering robust EPS growth, we believe Paul to be modestly paid. And given most shareholders are probably very happy with recent shareholder returns, they might even think Paul deserves a raise!

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for good natured Products that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance