Does Delta Air Lines (NYSE:DAL) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Delta Air Lines (NYSE:DAL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Delta Air Lines

Delta Air Lines' Improving Profits

Over the last three years, Delta Air Lines has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Delta Air Lines' EPS catapulted from US$2.97 to US$7.81, over the last year. It's not often a company can achieve year-on-year growth of 163%.

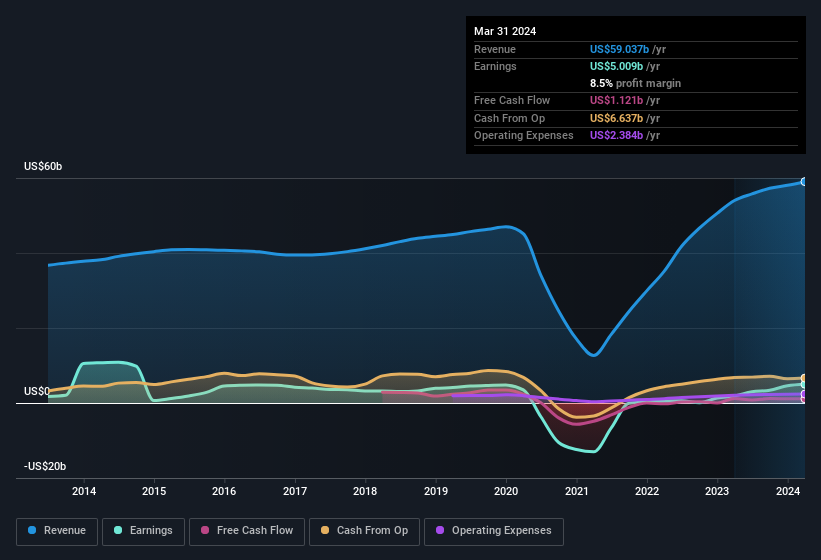

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Delta Air Lines' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Delta Air Lines remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.3% to US$59b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Delta Air Lines' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Delta Air Lines Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$31b company like Delta Air Lines. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$124m. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of Delta Air Lines but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations over US$8.0b, like Delta Air Lines, the median CEO pay is around US$13m.

The Delta Air Lines CEO received US$9.6m in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Delta Air Lines Deserve A Spot On Your Watchlist?

Delta Air Lines' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Delta Air Lines is worth considering carefully. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Delta Air Lines , and understanding it should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance