Does Austco Healthcare (ASX:AHC) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Austco Healthcare (ASX:AHC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Austco Healthcare

How Fast Is Austco Healthcare Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Austco Healthcare's EPS went from AU$0.0028 to AU$0.0095 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

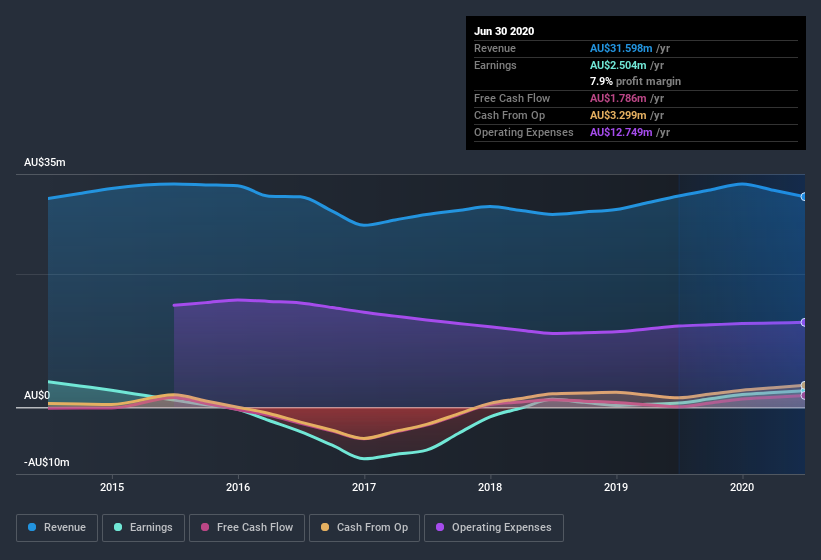

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes Austco Healthcare look pretty good, on balance; although revenue is flattish, EBIT margins improved from 0.09% to 4.1% in the last year. That's something to smile about.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Austco Healthcare is no giant, with a market capitalization of AU$28m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Austco Healthcare Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Austco Healthcare insiders spent AU$38k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. We also note that it was the CEO & Executive Director, Clayton Astles, who made the biggest single acquisition, paying AU$28k for shares at about AU$0.08 each.

On top of the insider buying, we can also see that Austco Healthcare insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only AU$28m Austco Healthcare is really small for a listed company. That means insiders only have AU$14m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Austco Healthcare To Your Watchlist?

Austco Healthcare's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Austco Healthcare belongs on the top of your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Austco Healthcare that you need to be mindful of.

As a growth investor I do like to see insider buying. But Austco Healthcare isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance