Does Advance Nanotek Limited (ASX:ANO) Go Up With The Market?

If you are looking to invest in Advance Nanotek Limited’s (ASX:ANO), or currently own the stock, then you need to understand its beta in order to understand how it can affect the risk of your portfolio. Every stock in the market is exposed to market risk, which arises from macroeconomic factors such as economic growth and geo-political tussles just to name a few. This is measured by its beta. Different characteristics of a stock expose it to various levels of market risk, and the market as a whole represents a beta value of one. A stock with a beta greater than one is considered more sensitive to market-wide shocks compared to a stock that trades below the value of one.

View our latest analysis for Advance Nanotek

An interpretation of ANO’s beta

With a five-year beta of 0.97, Advance Nanotek appears to be a less volatile company compared to the rest of the market. This means that the change in ANO’s value, whether it goes up or down, is expected to be smaller than the change in value of the entire stock market index. ANO’s beta implies it may be a stock that investors with high-beta portfolios might find interesting, if they wanted to reduce their exposure to the risk that a broad market downturn negatively impacts their portfolio.

Does ANO’s size and industry impact the expected beta?

ANO, with its market capitalisation of AU$41.01m, is a small-cap stock, which generally have higher beta than similar companies of larger size. Moreover, ANO’s industry, chemicals, is considered to be cyclical, which means it is more volatile than the market over the economic cycle. As a result, we should expect a high beta for the small-cap ANO but a low beta for the chemicals industry. It seems as though there is an inconsistency in risks portrayed by ANO’s size and industry relative to its actual beta value. There may be a more fundamental driver which can explain this inconsistency, which we will examine below.

Can ANO’s asset-composition point to a higher beta?

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I examine ANO’s ratio of fixed assets to total assets to see whether the company is highly exposed to the risk of this type of constraint. With a fixed-assets-to-total-assets ratio of greater than 30%, ANO appears to be a company that invests a large amount of capital in assets that are hard to scale down on short-notice. As a result, this aspect of ANO indicates a higher beta than a similar size company with a lower portion of fixed assets on their balance sheet. This outcome contradicts ANO’s current beta value which indicates a below-average volatility.

What this means for you:

ANO may be a worthwhile stock to hold onto in order to cushion the impact of a downturn. Depending on the composition of your portfolio, low-beta stocks such as ANO is valuable to lower your risk of market exposure, in particular, during times of economic decline. What I have not mentioned in my article here are important company-specific fundamentals such as Advance Nanotek’s financial health and performance track record. I urge you to complete your research by taking a look at the following:

Future Outlook: What are well-informed industry analysts predicting for ANO’s future growth? Take a look at our free research report of analyst consensus for ANO’s outlook.

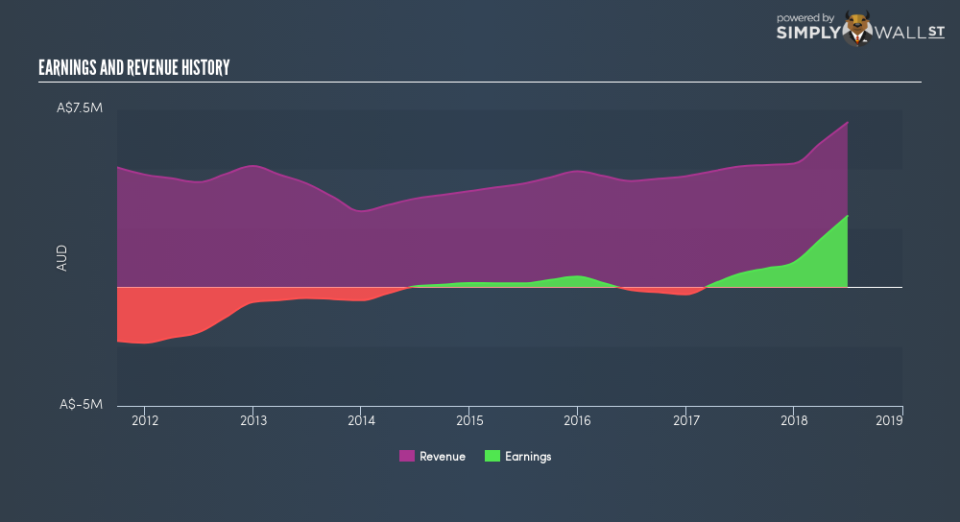

Past Track Record: Has ANO been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of ANO’s historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance