Discover 3 Top TSX Dividend Stocks With Yields Up To 7.5%

In recent discussions, experts like Craig Fehr from Edward Jones have been analyzing the ebbs and flows of the Canadian market, noting various economic trends and market conditions that influence investment strategies. Amid these observations, dividend stocks remain a compelling option for investors looking for potential steady income streams in a fluctuating economic landscape.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.57% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.84% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.69% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.80% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.54% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.59% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.59% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.01% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.71% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.74% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

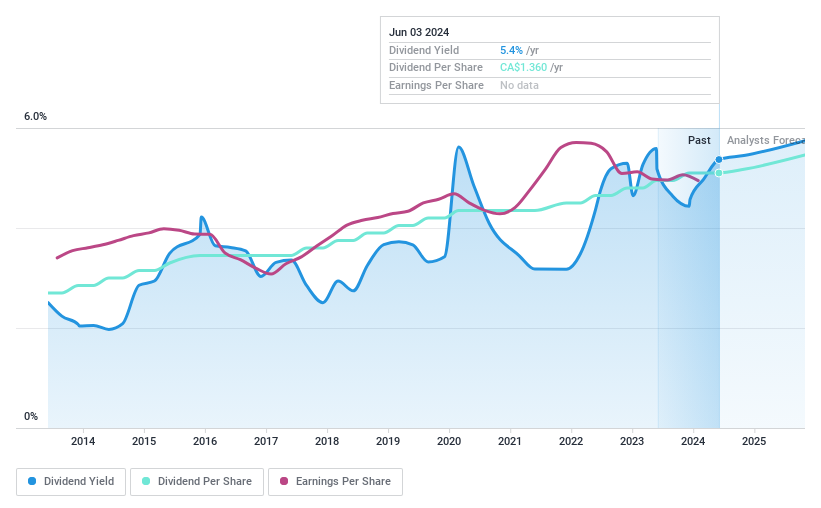

Canadian Western Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canadian Western Bank, operating primarily in Western Canada, offers a range of personal and business banking products and services with a market capitalization of approximately CA$2.45 billion.

Operations: Canadian Western Bank generates CA$1.08 billion from its banking operations.

Dividend Yield: 5.4%

Canadian Western Bank recently reported a solid performance with a net interest income of CA$249.76 million and net income of CA$83.48 million for Q2 2024, showing improvements from the previous year. The bank has increased its quarterly dividend to CA$0.35 per share, reflecting a consistent rise over the past decade. Despite trading 57.2% below estimated fair value and analysts predicting a potential price increase, its dividend yield at 5.37% remains lower than the top Canadian dividend payers. Additionally, with a payout ratio of 40%, dividends appear sustainable but broader long-term coverage data is lacking.

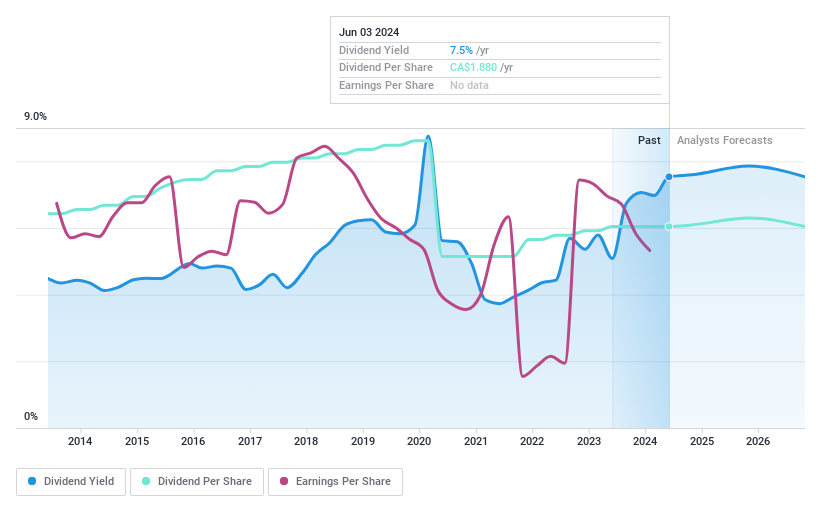

Laurentian Bank of Canada

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Laurentian Bank of Canada, headquartered in Montreal, offers a range of financial services to personal, business, and institutional clients across Canada and the U.S., with a market capitalization of approximately CA$1.09 billion.

Operations: Laurentian Bank of Canada generates revenue primarily through its Capital Markets segment, which contributed CA$0.96 billion.

Dividend Yield: 7.5%

Laurentian Bank of Canada's recent financial performance shows a challenging scenario with a net loss of CA$117.55 million in Q2 2024, contrasting sharply with the net income of CA$49.29 million from the previous year. Despite this downturn, the bank maintains its dividend commitment, declaring a regular quarterly dividend of 47 cents per share. However, historical data reveals inconsistency in dividend payments over the last decade, indicating potential concerns about their sustainability and reliability for long-term investors.

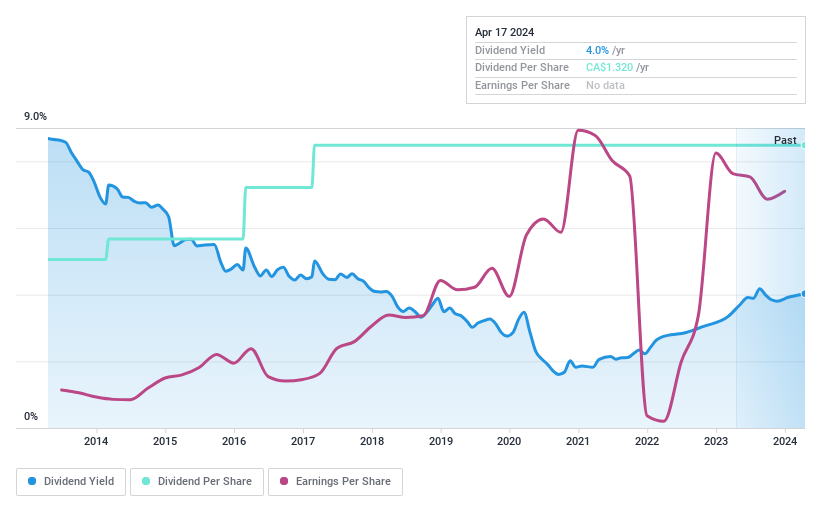

Richards Packaging Income Fund

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, operating in North America, specializes in the design, manufacture, and distribution of packaging containers and healthcare supplies with a market capitalization of CA$326.46 million.

Operations: Richards Packaging Income Fund generates CA$416.97 million from its wholesale miscellaneous segment.

Dividend Yield: 5.6%

Richards Packaging Income Fund offers a 5.64% dividend yield, which is slightly below the top Canadian payers. Its dividends are well-supported by a 38.5% earnings payout ratio and a 24.7% cash flow payout ratio, indicating sustainability. Despite lower sales and net income in Q1 2024 compared to the previous year, with CAD 97.88 million in sales and CAD 8.49 million in net income, the company has maintained stable monthly distributions of CAD 0.11 per unit.

Make It Happen

Click through to start exploring the rest of the 29 Top TSX Dividend Stocks now.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CWBTSX:LBTSX:RPI.UN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance