How the disastrous Fyre Festival defrauded investors out of US$27.4m

They were promised gourmet food, luxury accommodation and a spectacular line-up of musical acts.

What Fyre Festival’s unlucky attendees received was very different – disaster relief tents, no musicians to be seen, and as one punter revealed with horror, pre-made cheese sandwiches without butter.

It was an events fail of an epic proportion which has now spawned lawsuits, warnings around what Instagram influencers can promote (without disclosing they’ve been paid) and most recently, a Netflix documentary.

But how did Billy McFarland, the man behind Fyre Festival – now a convicted felon – actually convince and defraud investors of US$27.4 million?

This resurfaced investor pitch shows the beginning of the story

The pitch presentation was shown to potential investors and first leaked in 2017, but has resurfaced after being shared on Linkedin.

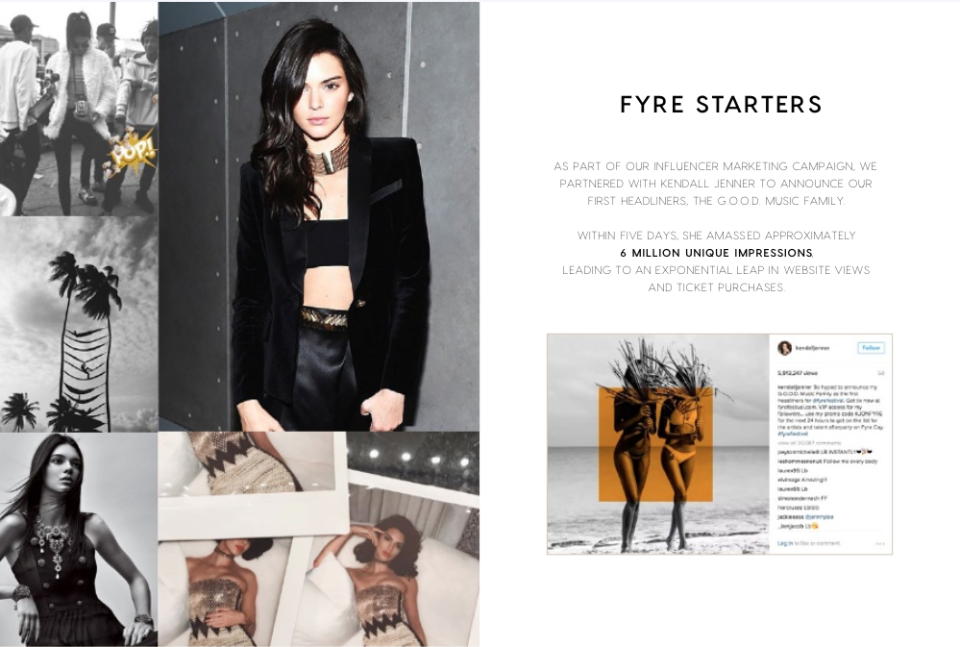

The slide deck asks investors to consider what would happen “if we reimagined what it means to attend a music festival”, and boasts dozens of high-profile models and Instagram influencers among the attendees and promoters.

Among them were those dubbed “Fyre starters”, like Bella Hadid and Kendall Jenner.

You can check out the full slide deck here.

The pitch, accompanied by falsified financial statements was enough for many investors.

Described by Judge Naomi Reice Buchwald as a “serial fraudster”, McFarland – while admitting to defrauding investors – said that he was just ignorant of the resources required to pull off a festival.

“I deeply regret my actions, and I apologise to my investors, team, family and supporters who I let down,” he said.

“I grossly underestimated the resources that would be necessary to hold an event of this magnitude”, he admitted.

“In an attempt to raise what I thought were needed funds, I lied to investors about various aspects of Fyre Media and my personal finances. Those lies included false documents and information.”

According to SEC documents obtained by The Daily Mail UK, McFarland sent investors a report showing that artists – including the likes of Jennifer Lopez and Selena Gomez – had offered funds totalling US$100 million.

The same documents falsely showed McFarland holding US$24 million in assets, and another US$2.56 million in Facebook shares. In reality, he had less than US$1,500 in Facebook shares.

He’s now been ordered to pay back US$26 million to investors.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Here’s how much you REALLY need to earn to buy a house in your city

Now read: Home prices in this city to PLUMMET another $60K, experts predict

Now read: You don’t have to be an early riser to be successful: 5 CEOs who wake at 10am

Yahoo Finance

Yahoo Finance