This Dirt Cheap Oil Stock Faces Some Major Challenges in 2019

The oil services industry, as a whole, has been a challenging one over the past few years as exploration and production companies have drastically scaled back capital spending. Within the industry, the two segments that have been some of the most difficult to make money in are drilling and pressure pumping (fracking). For Patterson-UTI Energy (NASDAQ: PTEN), weakness in these segments has been a double-whammy because they are Patterson's two largest businesses. This past quarter was particularly tough because many producers finished their capital spending plans for 2018 early and might not start back up again until later in 2019.

So let's take a look at what that meant for Patterson's bottom line in the fourth quarter and what management has been doing to navigate this rocky period for North American oil services.

Image source: Getty Images.

By the numbers

Metric | Q4 2018 | Q3 2018 | Q4 2017 |

|---|---|---|---|

Revenue | $795.9 million | $867 million | $787.3 million |

Operating income | ($210.8 million) | ($80.3 million) | ($21.6 million) |

Net income | ($201.2 million) | ($75 million) | $198.4 million |

EPS (diluted) | ($0.93) | ($0.34) | $0.88 |

DATA SOURCE: PATTERSON UTI ENERGY EARNINGS RELEASE. EPS = EARNINGS PER SHARE.

The good news is that this past quarter wasn't actually as bad as Patterson-UTI's bottom line would have you believe. Much of those losses are from asset impairments that are just on paper. Also, the company benefited from a sizable one-time gain in the year-ago period related to the changes in the corporate tax rates. Absent those one-time events, management estimates that its adjusted loss per share was $0.04 and $0.10 for the fourth quarters of 2018 and 2017, respectively. Those writedowns came in the company's pressure pumping and directional drilling businesses. Management noted that it was idling some of its pressure pumping equipment because it expects demand to be weak in the first half of 2019 and doesn't want to bid these assets out in an oversupplied market.

It's also worth pointing out that Patterson-UTI has invested a lot of money in upgrading its drilling rigs over the past few years, and those investments mean that the company has a lot of depreciation and amortization expenses. Again, these are paper losses that don't reflect the amount of cash coming in the door. Excluding those impairments, adjusted EBITDA for the quarter and for the fiscal year was $212 million and $806 million, respectively.

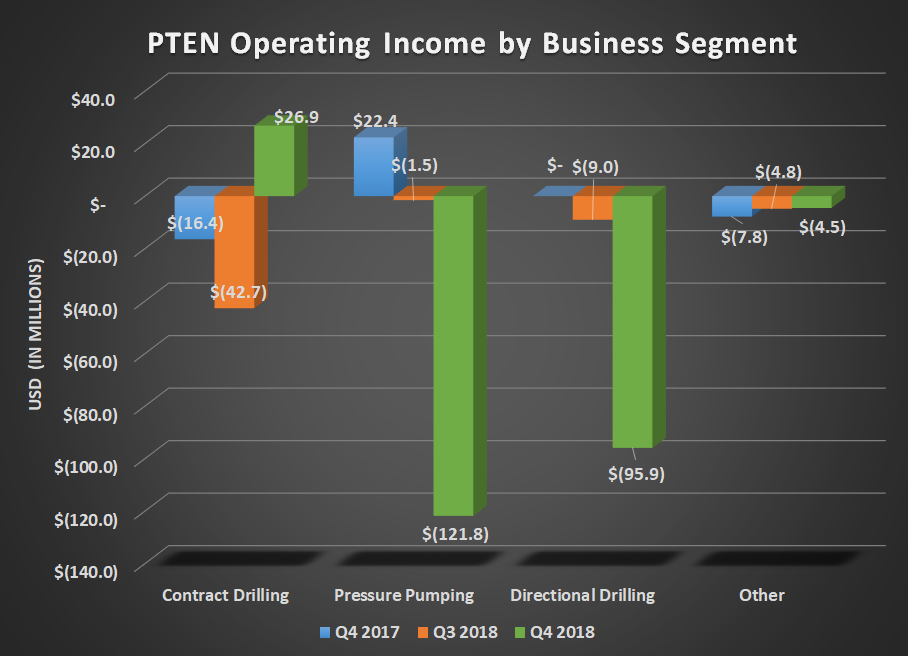

Another bright spot worth noting was that the company's contract drilling business was able to post a quarterly operating profit this quarter even though overall activity for North American shale was a fraction of prior quarters. Patterson-UTI noted that most of the profits for this segment were attributed to rigs under long-term contracts. One of its largest competitors, Helmerich & Payne, mentioned the same thing in its earnings report. Instead of shutting down all drilling and well completion activity, most producers elected to keep drilling wells but not completing them because their rigs were under long-term contracts whereas pressure pumping crews tend to do short-term spot work.

Data source: Patterson-UTI Energy. Chart by author.

The one thing that is a little peculiar in Patterson-UTI's earnings report is that the company took on quite a bit of debt in 2018 to pay for capital improvements on its rigs. At the same time, though, management has an active share repurchase program. It bought back $150 million in stock throughout 2018 and has the authorization to buy back another $250 million in 2019. You can understand why management thinks it's a good idea to buy back stock right now. Its shares are trading at a price-to-book-value ratio of 0.78, the lowest level since the Great Recession. So there is a lot of bang behind each buyback buck. At the same time, though, its debt-to-EBITDA ratio is now above 2.1 and it could likely get worse in the coming quarters.

What management had to say

On the company's conference call, Chairman Mark Siegel gave a quick recap of the challenges it faced this past quarter and what management is planning to do for the next few quarters in response to this recent downturn:

As I suspect everyone on this call is painfully aware, oil prices fell precipitously in the fourth quarter. The magnitude and speed of the oil price decline was surprising even for those of us who have witnessed many major fluctuations in oil prices. During the 82 days between October 3rd and December 24th, we saw a decrease in WTI of almost $34 or 44%. The timing of the sharp decline, no doubt, impacted plans for the first quarter 2019 drilling and completion programs. While we at Patterson-UTI don't have a crystal ball about oil prices, we are encouraged by the significant rebound in oil prices.

Since December 24th, we've seen oil prices increase by $11.21 or approximately 26% in 44 days. The sharp reversal of the trend suggests to us that the best explanation for these changes in oil prices may be the rise in mechanistic trading in oil with its greater connection to sentiment than to fundamentals. With oil prices now between $50 and $55, sentiment has improved. However, we suspect that some of our E&P customers will wait to see if these prices or possibly even higher prices remain in effect before solidifying their completion in drilling programs. If oil prices do move higher, we expect activity levels will improve.

You can read a full transcript of Patterson-UTI Energy's conference call here.

Are management's moves shrewd or reckless?

Patterson-UTI is in two of the most challenging segments of the oil services business: leasing rigs and offering pressure pumping services. For one, advancements in drilling technology have decreased the amount of time it takes a rig to complete a job. So even if a rig can charge more for its services, the amount of time on the job is much shorter and overall revenue tends to be lower. Also, pressure pumping is fiercely competitive and the company is going up against oil service giants like Halliburton and Schlumberger, which have greater scale. This can explain many of the issues Patterson-UTI has faced in recent quarters.

Management is trying to make the best of the situation by maintaining a fleet of highly capable rigs -- called "super spec" in the industry -- that can command higher rates and tend to work on long-term contracts. Also, idling pressure pumping equipment instead of putting it to work at low or even unprofitable rates makes sense because of the wear and tear this equipment takes on a job. These moves will likely mean lower revenue in the first half of 2019 but should help improve profitability further down the road.

Whether management is right to take on debt and buy back stock now is up for debate. If the drilling and pressure pumping business comes roaring back, then it will look like a stroke of genius. If this downturn lasts longer, though, then adding debt could put an unnecessary strain on its balance sheet. It will be worth watching in 2019 to see how this plan takes shape.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance