Dillard's (DDS) Stock Rises 14% as Q3 Earnings Beat Estimates

Shares of Dillard's Inc. DDS gained 14.2%, following the better-than-expected earnings in third-quarter fiscal 2019. Moreover, its comparable store sales (comps) and retail gross margin marked a significant improvement sequentially. Further, significantly lower inventory levels aided results.

Year to date, shares of the Zacks Rank #3 (Hold) company have increased 28.4% against the industry’s slump of 27.4%.

Q3 Numbers

Dillard's reported adjusted earnings of 23 cents, significantly beating the Zacks Consensus Estimate of a loss of 29 cents. However, the bottom line declined 14.8% from the year-ago quarter’s earnings of 27 cents per share.

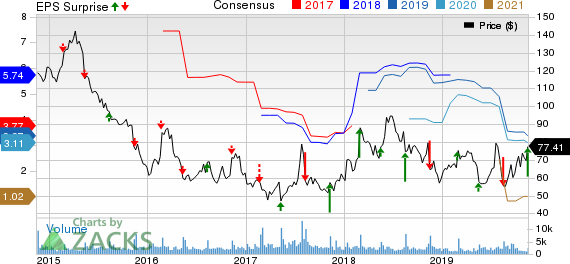

Dillard's, Inc. Price, Consensus and EPS Surprise

Dillard's, Inc. price-consensus-eps-surprise-chart | Dillard's, Inc. Quote

Net sales of $1,423.6 million declined 2.2% from the year-ago quarter. Excluding services and other income, sales fell 2.2% to $1,388.3 million. Merchandise sales (excluding CDI Contractors, LLC) dipped 0.6% to $1,334 million. The Zacks Consensus Estimate for sales was $1,404 million.

Comparable store sales (comps) for the 13 weeks (ended Nov 2, 2019) remained flat compared with a 3% increase in the year-ago quarter. However, comps for the quarter under review reflected an improvement on a sequential basis from a 2% decline reported in second-quarter fiscal 2019. Notably, the eastern region performed exceedingly well, followed by western and central regions.

Consolidated gross margin expanded 53 basis points (bps) in the fiscal third quarter. Gross margin from retail operations improved 13 bps mainly due to lower inventory levels. Notably, gross margin from retail stores reflected significant gain on a sequential basis from a decline of 319 bps reported in second-quarter fiscal 2019.

Dillard's SG&A expenses (as a percentage of sales) rose 60 bps from the prior-year quarter to 30.1%. In dollar terms, SG&A expenses (operating expenses) dipped 0.2% to $418.1 million. Meanwhile, retail operating expenses (as a percentage of sales) for the quarter under review increased 10 bps to 31.2%. In dollar terms, retail operating expenses were nearly flat at $416.6 million.

Financial Details

The company ended the fiscal third quarter with cash and cash equivalents of $79.1 million, long-term debt and finance leases of $366.7 million, and total shareholders’ equity of $1,612.4 million. As of Nov 2, 2019, merchandise inventories declined nearly 4% to $1,970 million. This compared favorably with flat inventories at the end of second-quarter fiscal 2019.

In the first nine months of fiscal 2019, the company generated operating cash flow of $23 million. Moreover, it remained committed to rewarding shareholders with dividends and buybacks.

During the fiscal third quarter, the company bought back 0.6 million shares for $35.2 million under its $500-million repurchase program announced in March 2018. As of Nov 2, 2019, it had share buyback authorization worth $305.4 million remaining under its program.

Store Update

As of Nov 2, 2019, Dillard’s had about 259 namesake outlets and 30 clearance centers, operating in 29 states, alongside an online store at www.dillards.com. The company’s total square footage as of Nov 2 was 48.9 million.

Further, it announced plans to open three stores by the end of fiscal 2019 and in the first quarter of fiscal 2020. Notably, the company plans to open expanded stores at Killeen Mall in Killeen, TX; Columbia Mall in Columbia, MO; and Richland Fashion Mall in Waco, TX. All these facilities will be dual-anchored locations, with two of the company-owned stores replacing existing leased stores. The company expects to open the Killeen-based store by the end of fiscal 2019, Columbia-based store in the first quarter of fiscal 2020 and the Waco-based store by early 2020.

Additionally, Dillard’s announced planned closure of its Fiesta Mall Clearance Center in Mesa, AR, by January 2020.

Fiscal 2019 View

For fiscal 2019, Dillard’s expects rentals of $27 million compared with $29 million in fiscal 2018. It anticipates net interest and debt expenses of $46 million, suggesting a decline from $53 million in fiscal 2018. Furthermore, the company now projects capital expenditure of $115 million for fiscal 2019 compared with $125 million stated earlier. Notably, it spent $137 million in fiscal 2018.

For fiscal 2019, it projects depreciation and amortization expenses of $224 million, suggesting no change from the fiscal 2018 level.

Looking for Better-Ranked Retail Stocks? Check These

Target Corporation TGT has a long-term earnings growth rate of 7.1% and a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Walmart Inc WMT currently has a long-term earnings growth rate of 4.7% and a Zacks Rank #2.

Ross Stores, Inc ROST presently has a long-term earnings growth rate of 10.5% and a Zacks Rank #2.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance