Did The Underlying Business Drive Jatenergy's (ASX:JAT) Lovely 331% Share Price Gain?

It hasn't been the best quarter for Jatenergy Limited (ASX:JAT) shareholders, since the share price has fallen 20% in that time. But over three years the performance has been really wonderful. In fact, the share price has taken off in that time, up 331%. Arguably, the recent fall is to be expected after such a strong rise. The share price action could signify that the business itself is dramatically improved, in that time.

See our latest analysis for Jatenergy

Jatenergy isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Jatenergy's revenue trended up 99% each year over three years. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 63% per year in that time. Despite the strong run, top performers like Jatenergy have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

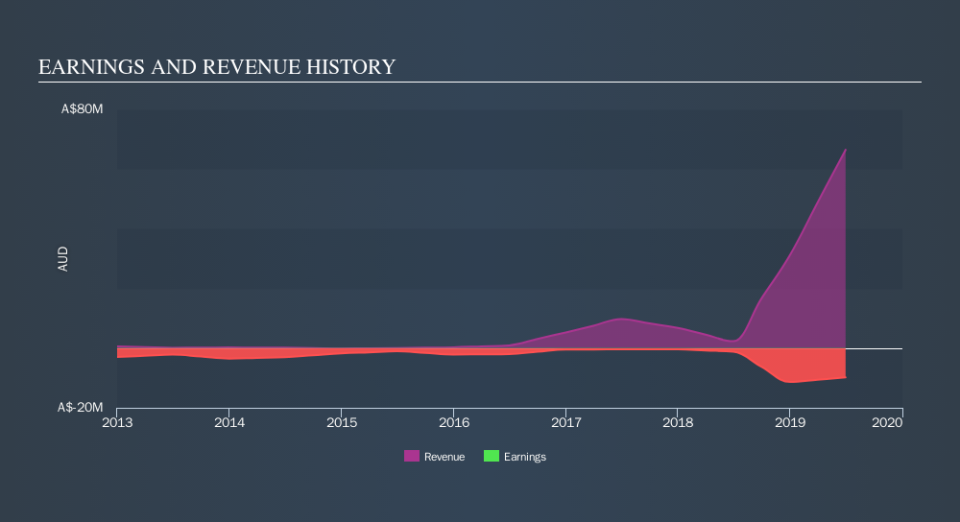

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Jatenergy's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Jatenergy's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Jatenergy hasn't been paying dividends, but its TSR of 339% exceeds its share price return of 331%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Jatenergy shareholders are down 31% for the year, but the market itself is up 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 18%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Jatenergy's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Jatenergy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance