Did The Underlying Business Drive Avita Medical's (ASX:AVH) Lovely 730% Share Price Gain?

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Avita Medical Limited (ASX:AVH) shares for the last five years, while they gained 730%. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 8.1% in thirty days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Avita Medical

Because Avita Medical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Avita Medical can boast revenue growth at a rate of 26% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 53%(per year) over the same period. Despite the strong run, top performers like Avita Medical have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

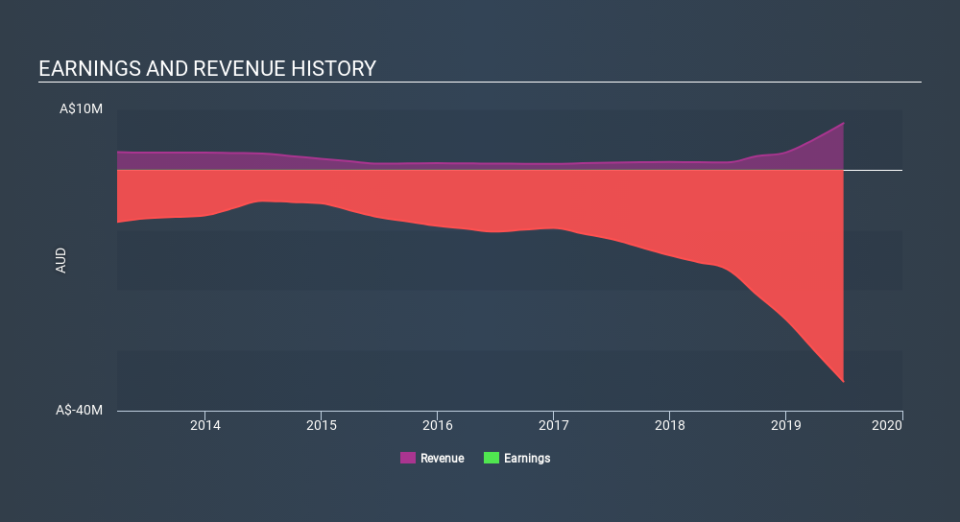

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Avita Medical's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Avita Medical's TSR, at 840% is higher than its share price return of 730%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Avita Medical has rewarded shareholders with a total shareholder return of 462% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 57% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Avita Medical better, we need to consider many other factors. For instance, we've identified 4 warning signs for Avita Medical (1 doesn't sit too well with us) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance