Did You Miss Field Solutions Holdings' (ASX:FSG) 28% Share Price Gain?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Field Solutions Holdings Limited (ASX:FSG) share price is up 28% in the last year, clearly besting the market decline of around 14% (not including dividends). So that should have shareholders smiling. We'll need to follow Field Solutions Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Field Solutions Holdings

Field Solutions Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Field Solutions Holdings grew its revenue by 25% last year. We respect that sort of growth, no doubt. Buyers pushed the share price 28% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

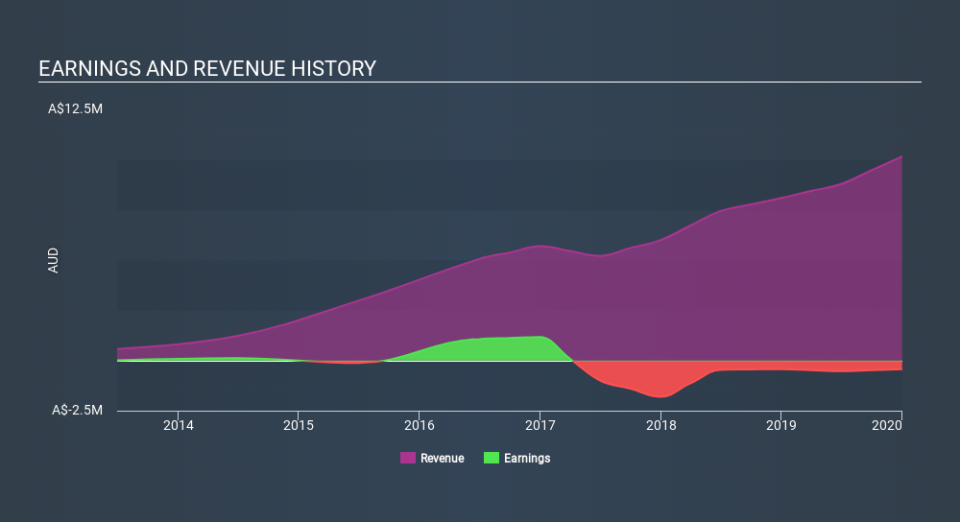

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Field Solutions Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Field Solutions Holdings shareholders have gained 28% over the last year. And the share price momentum remains respectable, with a gain of 15% in the last three months. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Field Solutions Holdings is showing 5 warning signs in our investment analysis , and 3 of those are significant...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance